If you’ve ever shopped online, you’ve probably been asked for your CVV security code when filling in your credit card details. Despite that, many people don’t really know what it is or why it matters. So, what is a CVV code on a credit card, and why is it so important?

In this guide, we’ll break down everything you need to know where to find your CVV, how it helps protect you, and the best practices for keeping it safe.

What Is CVV Code?

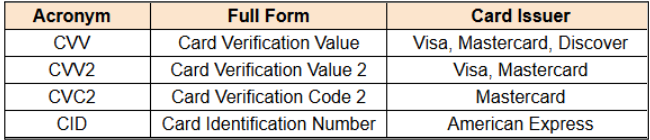

CVV stands for Card Verification Value. It is a three- or four-digit number printed on your credit or debit card. This number is a security feature to verify that the person making the transaction is in possession of the physical card.

For Visa, Mastercard, and Discover, the CVV is a three-digit code on the back of the card. For American Express, it’s a four-digit code on the front. Unlike your credit card number, the CVV is not embossed or stored on the magnetic stripe. It is designed specifically to reduce fraud in card-not-present transactions such as online or over-the-phone purchases.

Why Is the CVV Important?

CVV keeps you secure in several key ways:

1. Fraud Prevention

Even if someone obtains your 16-digit card number, they usually can’t complete online purchases without the CVV. It’s the extra piece of information that helps block fraudulent use unless the physical card itself is stolen.

2. Regulatory Compliance & Data Security

Merchants are not permitted to store CVV codes under PCI DSS rules. This means even if a retailer’s database is hacked, your CVV isn’t exposed as it’s only used briefly to verify a transaction and then discarded.

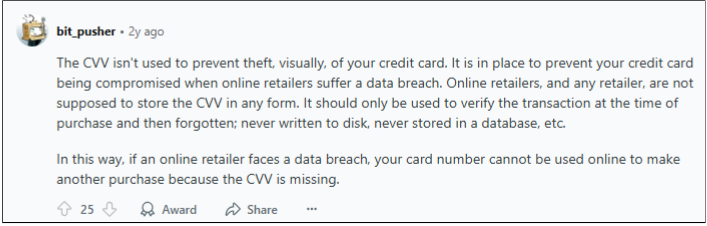

StackExchange explains this point cleanly:

“When you use your card in person, the merchant never gets your CVV... if an online retailer suffers a database compromise, your CVV should still be safe since they only had it for long enough to verify a transaction and didn’t store it.”

3. Transaction Authentication

The CVV provides quick confirmation that the buyer has the physical card, not just the card number. It’s a small detail that adds big assurance to card-not-present transactions.

CVVs aren’t foolproof and can’t stop phishing scams or malware. However, they remain one of the most effective safeguards for online and phone purchases.

How Is CVV Different from a PIN?

Many people confuse the CVV with a PIN (Personal Identification Number), but they are not the same:

- CVV: A three- or four-digit code printed on the card, used mainly for online or remote transactions to verify that the buyer has the card.

- PIN: A number chosen by the card holder and used at ATMs or point-of-sale terminals to authorize in-person transactions.

In short, CVV protects online payments, while the PIN secures in-person payments.

Types of CVV Codes

There are two main types of CVV codes:

- CVV1: Encoded in the magnetic stripe and used automatically during swiped transactions. Cardholders don’t see or use this code directly.

- CVV2: The three- or four-digit printed code you enter when shopping online or making remote payments.

Most consumers only interact with CVV2, which is why it’s commonly referred to as the “CVV security code.”

Why Do Merchants Ask for Your CVV?

Ever wonder why every online checkout page asks for that little 3- or 4-digit code on your card? It’s not a formality; and serves as a key part of payment security.

1. Reducing the Risk of Fraud

The biggest reason is fraud prevention. If a hacker or scammer only has your 16-digit card number, they can’t usually complete a purchase without the CVV. According to the Federal Trade Commission, credit card fraud remains one of the most common forms of identity theft in the U.S. Requiring CVVs makes stolen card numbers far less useful.

2. Compliance With Card Network Rules

Visa, Mastercard, and other networks require CVV verification for most online or card-not-present payments. This is part of PCI DSS (Payment Card Industry Data Security Standard) compliance, which sets rules to keep transactions safe.

3. Extra Layer of Verification

Especially during a first-time purchase with a retailer, the CVV provides quick proof that the buyer has the physical card in hand, not just the number.

4. Protection Against Chargebacks

For merchants, collecting CVVs also reduces liability. If a transaction turns out to be fraudulent, and no CVV was collected, banks may issue a chargeback, reversing the payment and leaving the seller with the loss.

How Hackers Try to Steal CVV Codes

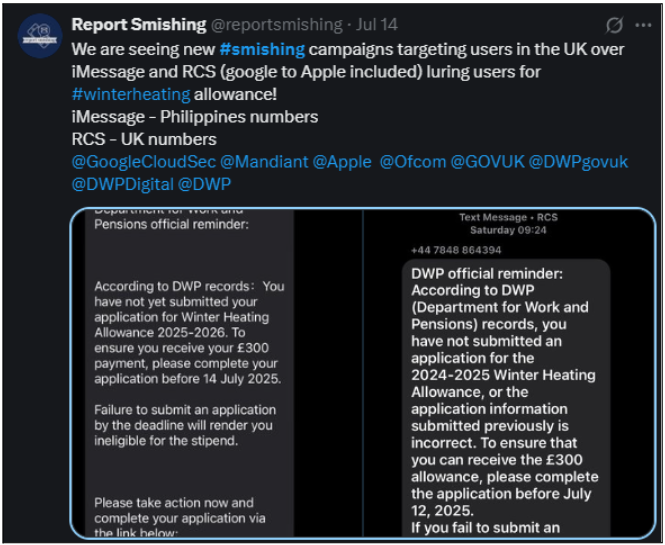

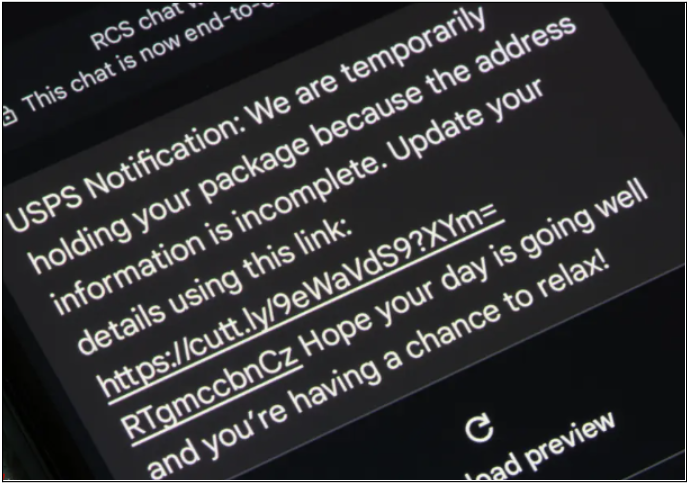

Hackers constantly update their playbook to trick you into handing over your CVV, and unfortunately, these tactics sometimes work. One of the biggest threats today is smishing, where scammers send text messages pretending to be from toll operators, banks, or courier services, claiming you owe a fee or need to resolve a delivery issue.

Victims who click on the link are redirected to a fake page and enter their card details, including the CVV, directly into the hands of cybercriminals. Industry reports suggest this method may have compromised millions of payment cards in just a year.

The FBI has even issued alerts urging consumers to delete suspicious texts immediately. And phishing isn't limited to emails anymore—malicious links hidden in SMS messages or QR codes are now leading ways attackers steal sensitive information.

However, there’s a silver lining: due to strict PCI DSS regulations, merchants aren’t allowed to store CVVs. This means large-scale data breaches don't typically expose CVVs, though malware and phishing remain serious risks.

How to Keep Your CVV Secure

Since the CVV is vital for protecting your transactions, here are a few steps to keep it safe:

- Never share your CVV on calls or emails. Legitimate banks will never ask for it.

- Use trusted websites. Look for HTTPS and secure checkout pages before entering card details.

- Enable two-factor authentication. Many banks now require OTPs (one-time passwords) or app confirmations in addition to CVV for extra security.

- Consider virtual cards. Some issuers provide temporary card numbers that generate unique CVVs for one-time or limited use.

- Monitor your statements regularly. Early detection of fraudulent activity can save you money and hassle.

- Use PureVPN: With PureVPN’s Dark Web Monitoring, you can scan the dark web for traces of your sensitive information, including credit card numbers. If your data is compromised, you’ll get real-time alerts so you can freeze your card, cancel subscriptions, or contact your ban quickly.

Do All Transactions Require a CVV?

Not every transaction requires your CVV, and that can be confusing. For example, when you sign up for a subscription service like Netflix or Spotify, the system will usually ask for your CVV during the first setup.

That first charge acts as a verification step to prove the card is real and in your possession. After that, the service providers don’t keep the CVV (they’re not allowed to under PCI DSS rules), but they can continue billing you without asking for it each month.

You’ll also notice this with merchants you’ve already used. If you’ve shopped on Amazon or booked a ride with Uber, you probably weren’t asked for your CVV every single time. That’s because once your card is saved securely in their system, they use tokenization—replacing your card details with a digital “stand-in” that allows them to process payments without re-checking the CVV.

That said, most merchants still require a CVV for new or one-time transactions, especially if it’s your first purchase on their site. By asking for the CVV upfront, the merchant adds an extra layer of protection before approving the payment. So, while you might not enter your CVV every single time, you can think of it as the initial security check that makes fraud harder.

Conclusion

The CVV code on a credit card may be small, but it has a big impact on keeping your online and phone transactions secure. By verifying that you physically have the card, the CVV helps reduce fraud risks and ensures safer payments. And with PureVPN’s Dark Web Monitoring tool, you can track if your card details appear in risky places, and take swift action to protect yourself.

Frequently Asked Questions

-

Can someone use my credit card without the CVV?

They may be able to for certain recurring charges, but most merchants require a CVV for new transactions, making it harder for thieves to misuse your card.

-

What happens if I enter the wrong CVV code?

The transaction will typically be declined, as the CVV must match the card issuer’s records.

-

What is a dynamic CVV?

A dynamic CVV is a code that changes regularly, either through a digital card display or a mobile app, offering enhanced security.

-

Can I change my CVV code?

No, CVVs are fixed to your card. The only way to “change” it is by requesting a new card from your bank, which will automatically generate a new CVV.

-

Is it safe to give my CVV over the phone?

Yes, if you’re calling a trusted merchant or service. But never share your CVV with someone who contacts you unexpectedly, even if they claim to be from your bank.

-

Is CVV required for contactless or Apple Pay/Google Pay transactions?

No, digital wallets like Apple Pay or Google Pay rely on tokenization and device authentication (such as Face ID or a fingerprint), so they don’t require the CVV for each tap.