Table of Content

- How Can I Check If My Bank Account Details Are Posted on the Dark Web?

- What Should I Do to Protect My Bank Account Details from Dark Web Leaks?

- How Did My Bank Account Details Appear on the Dark Web?

- Is It Possible to Remove My Bank Account Details from the Dark Web?

- Protect Yourself from Doxing and Identity Theft With PurePrivacy

- Frequently Asked Questions (FAQs)

- In Conclusion!

Ever felt your private information is exposed to vicious hackers and scammers who lurk around the dark web?

The thought alone sends chills down the spine!

The dark web is a scary, hidden place on the internet that can only be accessed with a specialized Tor browser.

It is a breeding ground for multiple scams, data theft, and illegal activities.

And it’s no coincidence that you get to hear about data leaks and breaches more frequently than ever.

74% of banking and insurance attacks compromised clients' personal information.

In comparison, 68% of breaches featured a human component that wasn't intentional, such as someone falling prey to social engineering or making a mistake.

If your bank information is compromised or posted on the dark web, don’t wait for a miracle to restore your privacy!

Discover if Your Most Critical Identifiers Have Been Exposed on the Dark Web

Receive timely alerts and actionable insights with PurePrivacy's Dark Web Monitoring.

How Can I Check If My Bank Account Details Are Posted on the Dark Web?

Unfortunately, there's no reliable method to determine whether your bank account data is available on the dark web.

Searching for certain information on the dark web is challenging since it is a hidden network that is not indexed by conventional search engines.

You can still monitor your accounts for suspicious activity using a few indirect techniques we’ll discuss later.

A dark web monitoring service may also be useful since it may notify you if your personal information is discovered on the dark web.

What Should I Do to Protect My Bank Account Details from Dark Web Leaks?

If you believe you could be a victim of identity theft, hacking, or financial fraud because your information is on the dark web, it’s time to take action right away:

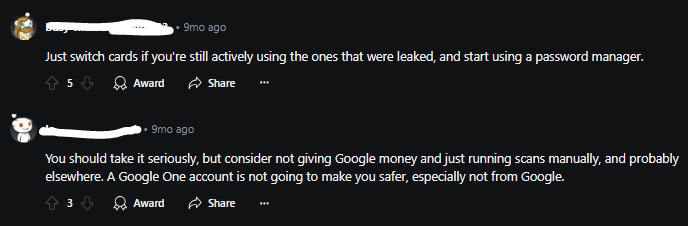

Freeze your Credit Cards

Credit freezing prevents fraudsters from establishing new accounts in your name. Contact Equifax, Experian, and TransUnion separately.

Change Your Passwords

Alter your online banking, social networking, and email passwords. For strong and distinctive passwords, use a password manager.

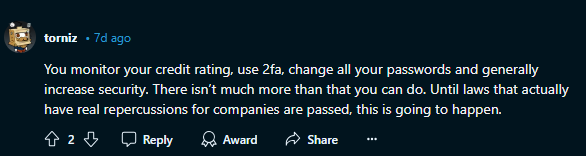

Turn on Two-Factor Authentication

This requires an additional email address or device login step. To increase security, think about using an authenticator app.

Check Out Your Credit Report

Visit AnnualCreditReport.com for a free report and look up any unidentified accounts or inquiries.

Monitor Your Bank Statements

Check your credit card and bank statements frequently for unusual activity. If charges are found early, your bank may be able to reverse them.

How Did My Bank Account Details Appear on the Dark Web?

There are several ways your data might end up on the dark web, which includes compromised online accounts, data breaches, leaks, or even through a device infected with malware.

Having your personal information on the dark web can put you in grave danger, regardless of how it got there.

Here's how your data can reach the dark web:

Identity Theft

Identity thieves can generate false identification documents in your name, gain access to your bank accounts, and apply for government benefits.

Phishing and Scamming

Fraudsters tailor their frauds and phishing attempts using your information to make them look more authentic and convincing.

Loan Fraud

Identity thieves may obtain loans using your stolen identity, leaving you with a bad credit score and a mountain of debt.

Compromised Social Media Accounts

Hackers could take over your internet accounts. Passwords may be leaked through data breaches, or they can infer your other private online accounts.

Social Engineering Attacks

Cybercriminals may put you in grave legal jeopardy. Scammers could use your PII to carry out medical, employment, or tax fraud in your name.

Is It Possible to Remove My Bank Account Details from the Dark Web?

Unfortunately, if your bank account details are posted on the dark web, chances are other private information (SSN, physical address, email address, contact number) may have been compromised.

And you can’t point fingers on anyone because it is impossible to trace the whereabouts of the person who posted your personal data on the dark web.

If you have never used the dark web, then we suggest don’t snoop around for your information.

You might end up downloading malware on your device or become a victim of common dark web scams.

The best course of action is to start using a dark web monitoring service that sends you alert notifications, so you can freeze credit cards and change passwords before the damage is done.

Protect Yourself from Doxing and Identity Theft With PurePrivacy

There are grave risks associated with doxxing, identity theft, and disclosing personal information about an individual to the public.

PurePrivacy is a complete online security solution that enhances your privacy and protects you from these threats.

- Use Dark Web Monitoring to get data breach alerts on your mobile devices.

- Use Tacker Blocker to prevent known trackers from collecting your online data.

- Use Remove My Data to send recurring opt-out requests to supported data brokers.

- Use Social Privacy Manager to prevent cyber attackers from using them to profile you for unsolicited advertisements.

Scan the Dark Web 24/7

Monitor the dark web consistently to promote improved online security practices by tracking your internet activity and risks.

Avoid Unnecessary Tracking

Make browsing easier and more pleasurable by reducing the clutter and distractions from excessive tracking.

Send Opt-Out Requests to Data Brokers

Using the in-app dashboard, you can monitor the status of opt-out requests and get weekly data.

Manage Social Privacy Settings

Get easy management and social media profile optimization with robust security settings recommendations.

Frequently Asked Questions (FAQs)

-

What occurs if your private data is exposed on the dark web?

Hackers exploit the information collected to support additional illegal activities by merging data and applying it again in later attacks.

-

How can the scammer steal my bank details?

When you join up for a free trial on an insecure website, scammers can obtain your bank account details through fake telemarketer calls or by stealing them from those websites.

-

Can I provide the sort code and bank account number?

Similar to your account number and sort code, these are usually secure to disclose. However, you should only give this banking information to reputable people and businesses.

-

Which method of sending your bank details is the safest?

You have several options for sharing your bank information: email, phone, in-person, secure messaging within your banking app, etc. The safest option is to send this information using the encrypted messaging feature in your banking app.

In Conclusion!

The dark web is a serious threat to your online security, finances,l and personal data.

By being aware of the potential risks and adopting the necessary safety measures, you can reduce the risk of cybercrimes and identity theft.

You can use PurePrivacy with a VPN to get a helping hand in data removal, social media privacy, dark web monitoring, and block internet trackers.