Credit can be a powerful financial tool, but only if you know how to use it wisely. For those with limited or damaged credit history, a secured credit card provides a practical way to build or rebuild credit. Unlike traditional credit cards, it requires a refundable security deposit that protects the lender while improving the applicant’s approval odds.

In this guide, we’ll explore how secured credit cards work, their benefits and drawbacks, who is eligible, and how they can strengthen your financial future.

What is a Secured Credit Card?

A secured credit card is a type of credit card that requires a refundable security deposit as collateral. This deposit usually becomes your credit limit. For example, if you deposit $500, your credit limit is typically $500.

Unlike prepaid cards, secured cards report your activity to major credit bureaus. This reporting is what makes them valuable for building credit.

Key Characteristics of a Secured Credit Card

When you look at a secured credit card, there are a few defining features that make it different from a traditional (unsecured) credit card. Each plays an important role in how the card works and why it’s useful for people building or repairing credit.

1. Security Deposit

To open a secured card, you must put down an upfront cash deposit, often between $200 and $1,000. This deposit isn’t a fee; it’s collateral for the bank in case you fail to make payments. As long as you manage the account responsibly, you’ll eventually get this money back.

2. Credit Limit

The amount you deposit usually becomes your credit limit. For example, if you deposit $500, you’ll generally have a $500 spending limit. Some issuers may allow you to increase your limit later by adding more to your deposit or upgrading you to an unsecured card after consistent on-time payments.

3. Credit Reporting

Unlike prepaid debit cards, secured cards report your activity to the three major credit bureaus, Experian, Equifax, and TransUnion. This reporting allows you to build or rebuild your credit history since your payment behavior directly affects your credit score.

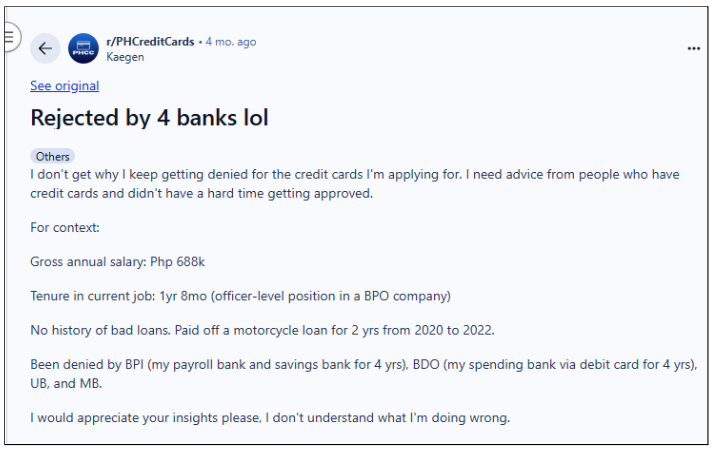

4. Eligibility

Because the deposit reduces risk for the bank, secured credit cards are much easier to qualify for compared to traditional unsecured cards. People with little or no credit history, or those with past financial issues, often find this type of card to be one of the most accessible ways to re-enter the credit system.

How Does a Secured Credit Card Work?

Secured credit cards function much like standard credit cards, with the deposit acting as a safety net for the bank. Here’s how the process typically works:

- Apply for the Card: The application process is similar to a regular credit card, but approval is usually easier since the deposit reduces lender risk.

- Make a Security Deposit: The amount you put down (often between $200–$1,000) generally becomes your spending limit.

- Use the Card: Make everyday purchases at stores or online just as you would with a traditional credit card.

- Pay Your Balance: You’ll receive a monthly statement. Paying on time (and ideally in full to avoid interest) is crucial.

- Build Credit: Your payment history is reported to the credit bureaus, helping you build or rebuild credit.

- Upgrade to Unsecured: Many issuers may upgrade you to a regular unsecured card after consistent responsible use, refunding your deposit in the process.

4 Reasons to Choose a Secured Credit Card for Building Credit

A secured card can help you gain financial stability and rebuild your credit standing. Here are some advantages of using one:

- Build or Rebuild Credit: Secured cards are ideal for anyone starting their credit journey or recovering from past financial mistakes. Because issuers report your payments, responsible habits directly strengthen your credit profile.

- High Approval Rates: Since the deposit lowers risk for banks, secured cards often have higher approval chances than unsecured cards, even if your credit history is weak.

- Financial Discipline: Your credit limit is tied to your deposit, naturally encouraging responsible spending. This makes secured credit cards useful for people working to avoid overspending.

- Potential to Upgrade: Some issuers may allow you to graduate to an unsecured card after about 12–18 months of consistent on-time payments. At that point, you’ll get your deposit back.

Are Secured Credit Cards Risky?

While secured credit cards are powerful tools, they’re not without limitations. It’s important to understand the downsides before applying. You need to put down a cash deposit, and tying up that money can be inconvenient if you’re short on funds.

If you manage your account responsibly, you’ll get this money back when you close the card in good standing or upgrade to an unsecured one. Moreover, some secured cards come with annual fees or higher-than-average interest rates.

Always review the terms carefully before applying so you don’t end up paying more than necessary. Plus, unlike flashy travel cards or cashback cards, most secured options don’t offer big perks. They’re designed primarily as credit-building tools rather than rewards cards.

Who Should Consider a Secured Credit Card?

A secured card can make sense in several financial situations. Here’s who benefits most:

- Individuals with no credit history, such as students or newcomers who need to start building credit from scratch.

- People with poor or damaged credit who want to rebuild responsibly.

- Those wanting to demonstrate responsible credit use before moving on to traditional unsecured cards.

How to Use a Secured Credit Card Effectively

Before you apply for a secured credit card, it’s helpful to understand best practices. These habits maximize the benefits of having one:

- Choose the Right Card: Not all secured cards are equal. Some charge high or unnecessary fees, or don’t report to all three credit bureaus. Always research carefully before applying.

- Pay on Time: Your payment history is the most important factor in your credit score. Setting up automatic payments can ensure you never miss a due date.

- Keep Utilization Low: Even with a modest credit limit, try to use less than 30% of it. For example, if your limit is $500, aim to stay under $150. This shows lenders you manage credit wisely.

- Monitor Your Credit Score: Check your progress regularly using free credit score apps or annual credit reports. Tracking your progress helps you stay motivated.

- Upgrade When Possible: After about a year of responsible use, many issuers allow you to transition to an unsecured card. This will return your deposit and can unlock higher limits.

Secured vs. Unsecured Credit Cards

Secured and unsecured cards share similarities but differ in key aspects. Here’s a quick comparison.

| Feature | Secured Credit Card | Unsecured Credit Card |

| Deposit Required | Yes | No |

| Approval Chances | Higher, even with poor credit | Dependent on credit history |

| Credit Building | Yes | Yes |

| Rewards | Limited | Wide variety |

| Upgradability | Yes (in many cases, to unsecured) | Already unsecured |

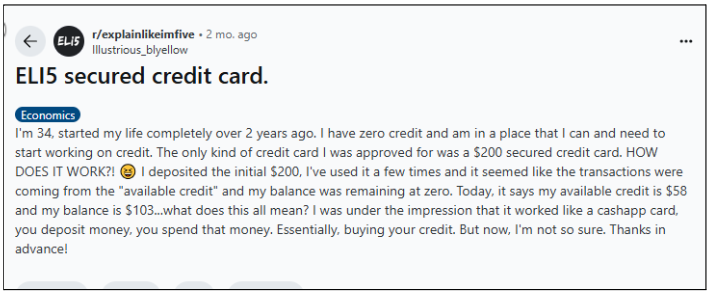

Common Misconceptions About Secured Credit Cards

There are a few myths about secured credit cards that float around, and they often scare people away or cause misunderstandings.

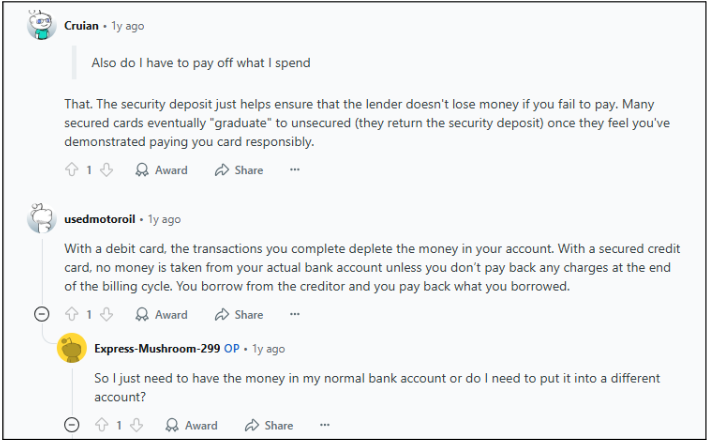

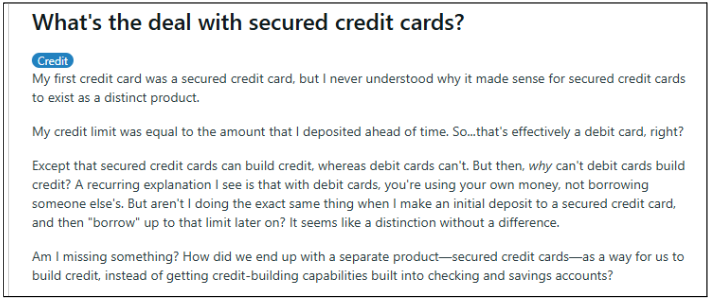

1. “It’s Just a Prepaid Card.”

This is a major myth. A prepaid card is like loading money into a digital wallet—you spend what you load up front. A secured credit card, on the other hand, works much more like a traditional credit card: you borrow upfront and pay later.

One Reddit user put it simply: “A secured credit card is like any other credit card... It does not come out of your deposit.”

That means your refundable deposit isn’t used for purchases; it’s held as backup in case you fail to pay. You're still borrowing, and your activity is reported to credit bureaus.

2. “The deposit covers my payments.”

Nope, that’s not how it works. Your deposit doesn’t pay your monthly bills; it’s collateral, not a budget substitute.

As one Redditor explained clearly: “With secured credit, it’s exactly like any other credit card… you just paid money to cover the balance, to protect the company if you stop making payments.”

So the money is essentially locked away, not spent. You still must pay off what you charge, just like a regular card.

3. “It won’t help my credit.”

This is flat-out wrong, and widely debunked by both users and experts. Secured credit cards are designed to help you build or rebuild your credit, provided they report to the major bureaus.

According to a user on Reddit:

“A common misconception is that secured cards are inferior to unsecured cards when it comes to building credit, secured cards report and accomplish the same exact thing as unsecured cards.”

Conclusion

A secured credit card is one of the most effective tools for building or rebuilding credit. By requiring a security deposit, issuers minimize their risk while giving you the chance to demonstrate responsible financial behavior.

When used correctly, such as by paying on time, keeping utilization low, and monitoring your credit, a secured card can help you transition to an unsecured credit card and set you on the path toward financial freedom.

Frequently Asked Questions

-

How much deposit is required for a secured credit card?

Most issuers typically require deposits ranging from $200 to $1,000. Higher deposits may lead to higher credit limits.

-

Can I get my deposit back if I apply for a secured credit card?

Yes. If you close the account in good standing or upgrade to an unsecured card, your deposit is refunded.

-

Will a secured card guarantee credit approval?

Approval chances are higher than unsecured cards, but not guaranteed as issuers still review your financial profile.

-

How long should I keep a secured credit card?

You should keep a secured credit card for 12–18 months, until you’ve built a credit history strong enough for unsecured options.

-

Do secured cards have rewards?

Some do, but rewards are often limited compared to unsecured cards.

-

What happens if I default on payments while using a secured card?

The issuer may use your deposit to cover unpaid balances, but this does not erase the damage—missed payments will still negatively affect your credit report.