Do you want to get rid of your Affirm account? If so, you've found the ideal spot! We'll walk you through the process of immediately completely canceling your Affirm account.

This comprehensive blog allows you to ensure that no personal information is being shared without consent and to avoid any financial obligations in the future.

We'll take you step-by-step through the procedure so you know how to do it correctly. Continue reading to learn how to regain control of your online activities and delete your Affirm account! In addition, learn how to use PurePrivacy for complete control of your privacy.

What Is an Affirm?

Affirm Holdings, an American public corporation, was created by PayPal co-founder Max Levchin in 2012. This finance startup offers online and in-store customers a buy now, pay later option.

Leading the U.S. buy now, pay later market, Affirm has over 17 million members and an annual gross sales value of US$20.2 billion as of 2023. Affirm provides its customers with loan options via several channels, such as an electronic payment link during online checkout, a virtual card, or an actual card.

The business gets money by collecting customer interest, imposing a service fee on retailers, or doing both.

Why Is It Important to Delete an Affirm Account?

Affirm account deletion is something you might want to think about for the following reasons:

No Longer Need to Affirm Financing

- You have paid back all of your transactions with Affirm, so you are not required to get the account open if you don't intend to use it for any more transactions.

- You can close your account permanently without impacting your credit score.

Concerned about Using Credit

- Affirm is one type of credit, Using credit is something to be cautious about because it can affect how you use your credit rate.

- Deleting the Affirm account will help you overcome the urge for credit management.

Discovered An Alternative Finance Option

- Maybe you've discovered a credit card with a more attractive points scheme or a more affordable interest rate.

- In this situation, you can delete the Affirm account and go with the new selection.

Security Issues

- You have the option to cancel your account with Affirm if you are concerned about the safety of your banking data.

How to Delete an Affirm Account

- Go to affirm.com and click on the “Help” button which is located at the top right corner of the screen.

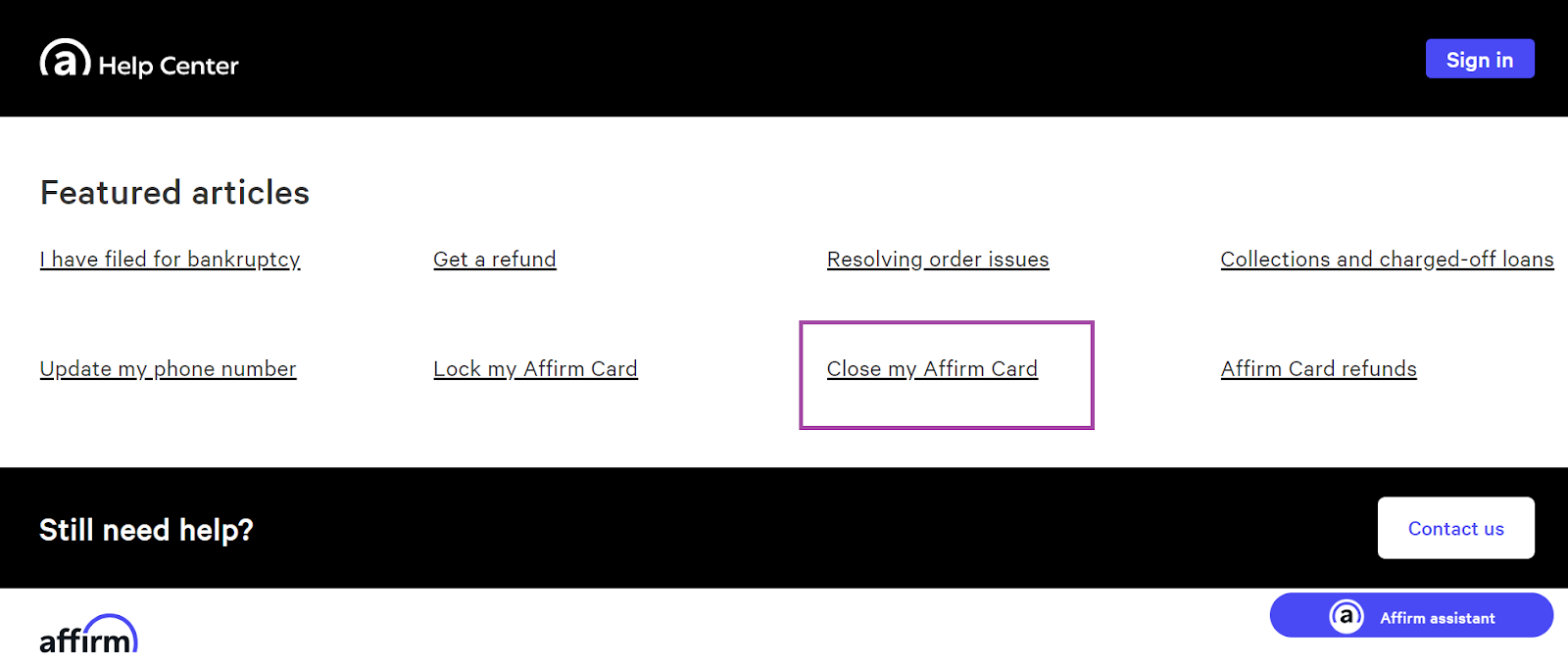

- Once you are in the help center, scroll down to the page where you will find “Close my Affirm card. Just go ahead and click on that link

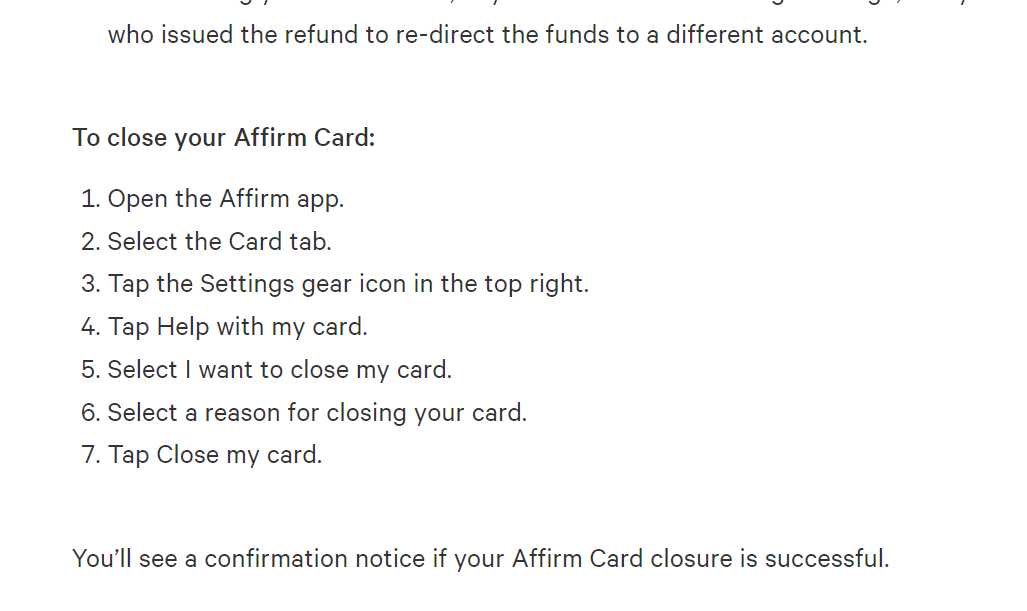

- Now you will see the article on how to close your card. At the bottom of the page, you will find the instructions you can follow to close your account.

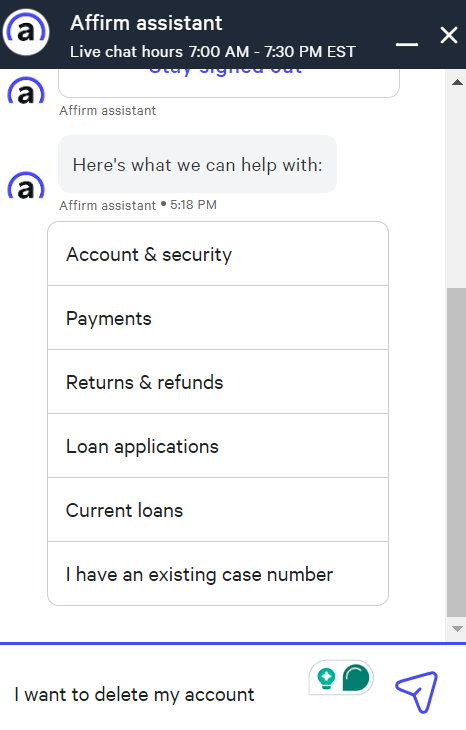

4. Or you can navigate to another option which is displayed at the bottom right corner of the page and says “Affirm assistant”, click on it and you will see the live chat box opened. Type “I want to delete my account”.

That's how you can delete your Affirm account.

Things to Keep In Mind before Deleting Affirm Account

There are a few things to consider before deactivating your Affirm account:

Ongoing Balance

If there are any unpaid loans, you will not be allowed to delete your account. Before starting the closing process, be sure all of your purchases have been paid for.

Obtaining Historical Information

You will no longer be able to view the loan's history or determine how much you can spend if you delete your account.

Improve Your Safety with PurePrivacy

PurePrivacy is an effective tool for increasing your online security by protecting your passwords and important information.

It simplifies access by putting data security and privacy first by providing users with a secure place to keep and oversee their login credentials across multiple websites and applications.

How Does it Work?

Account Analysis

- Your social media accounts are thoroughly scanned by PurePrivacy to find any security gaps and privacy concerns.

- The research includes limitations on access, sharing information permissions, and profile exposure settings.

Personalized Security Levels

- Customers are free to select the level of protection that best suits their needs, privacy concerns, and personal interests.

- PurePrivacy provides specific guidance to strengthen account security by customizing its recommendations.

One-Tap Suggestions

- Because of PurePrivacy's simple-to-use interface, putting specified security measures into practice is simple.

- With just one swipe, users may instantly implement recommended adjustments to their social media accounts, simplifying the process of improving privacy settings and lowering the possibility of unapproved data exposure.

Security Features

Improved Privacy Settings

- With PurePrivacy, users may strengthen their social media privacy by detecting and fixing possible weaknesses in the setups of their accounts.

- Users can lessen the chance of unwanted access to private data by effectively changing settings and permissions.

Fast Notifications and Updates

- Through PurePrivacy's frequent updates and notifications, stay up to date on the most recent privacy features and settings on social media networks.

- This guarantees that users can quickly put suggested security measures into practice to protect their online presence and stay informed about new dangers.

Simplified Security Operations

- Handling social media privacy is made simple with PurePrivacy, which removes the uncertainty involved in figuring out complicated privacy settings on many sites.

- PurePrivacy reduces the effort of keeping strong privacy protections on a variety of social networking platforms.

Frequently Asked Questions (FAQs)

-

Is it possible to terminate an Affirm savings account?

Terminate the account after the first working day of the month, when they deposit your interest, to maximize your interest gains. Find out more about the crediting and calculation of interest. Click or hit the 'Contact Us' link on the help center page to end your savings account.

-

Does Affirm allow me to cancel?

To arrange an exchange or cancel an order, get in touch with the store where you originally purchased the item. The store will adhere to its return, cancellation, order missing, and damaged or faulty goods policies. Your order cannot be canceled or refunded by Affirm until they get confirmation from the retailer.

-

Could I open my closed Affirm account again?

Please use the 'Contact Us' option to get in touch with the support team if you want to open up your Affirm account after closing it in the past. They will respond to your request. Please be aware that reactivating the account may not always be possible and that doing so does not ensure that your loan will be approved.

-

What will happen if I stop paying Affirm?

Affirm never imposes penalties for paying late, yet they could charge off the loan if you haven't made any payments for longer than 120 days. A loan may at any point be handed over to a third-party collections company after it has been paid off.

-

What is the duration of the Affirm cancellation policy?

Order cancellations must be handled via the retailer exclusively. For cancellation requests, kindly get in touch with the partner seller. They will automatically cancel the loan within 21 business days if your purchase was previously canceled.

-

Is there a refund policy with Affirm?

Interest is the only expense associated with obtaining funding from Affirm, thus it is not refundable. Your purchase balance will be applied to the funds you pay with Affirm first, followed by interest. The total amount of your return will be less than the amount of interest you paid in advance.

Taking Charge and Making Privacy a Priority

When you delete your Affirm account, particularly when your amount has been paid, you can be guaranteed that your banking data won't be utilized for any future purchases and your financial life will become simpler.

Online safety, however, is more than just account security. By protecting passwords, checking social media for safety risks, and providing specific privacy guidance, PurePrivacy gives you the power to take charge.

With PurePrivacy, you can improve privacy settings, optimize security procedures, and get quick updates for a safer digital experience.