Albert is one of the most popular programs for online financial management. However, there are a few reasons you may want to remove your account.

But don't worry, all of your concerns regarding your Albert account deletion procedure have been answered in this entire blog.

You will discover quick and easy methods for deleting your Albert account as well as how to use PurePrivacy to restore your online privacy.

What Is Albert?

Albert is one of the most popular financial and banking apps for handling your private finances. Users can monitor their expenses, stick to their budgets, and make financial savings with its assistance.

Strong security, FDIC assurance, the Securities and Investment Commission protection, and other features are among the services provided.

The software, which has over 12 million users, includes financial services, saving, investing, budgeting, and easy communication with the team of financial specialists, known as the Geniuses, who offer guidance on any financial subject.

Why Is It Necessary to Terminate Your Albert Account?

There are several reasons why you would want to delete your Albert account. When you realize you are not using the Albert account any longer, you may want to delete it.

If you have any concerns regarding the security of your financial data, you may wish to delete your Albert account to preserve your private data. If you wish to shift platforms or banks, you should consider removing your existing account.

For any reason for deletion of an account, you can be certain that your banking and personal information is no longer stored on Albert's systems by terminating your account.

How to Delete Your Account from Albert

- To delete your account from Albert, you have to click on https://albert.com/ this link opens Albert's page, and log in to your account.

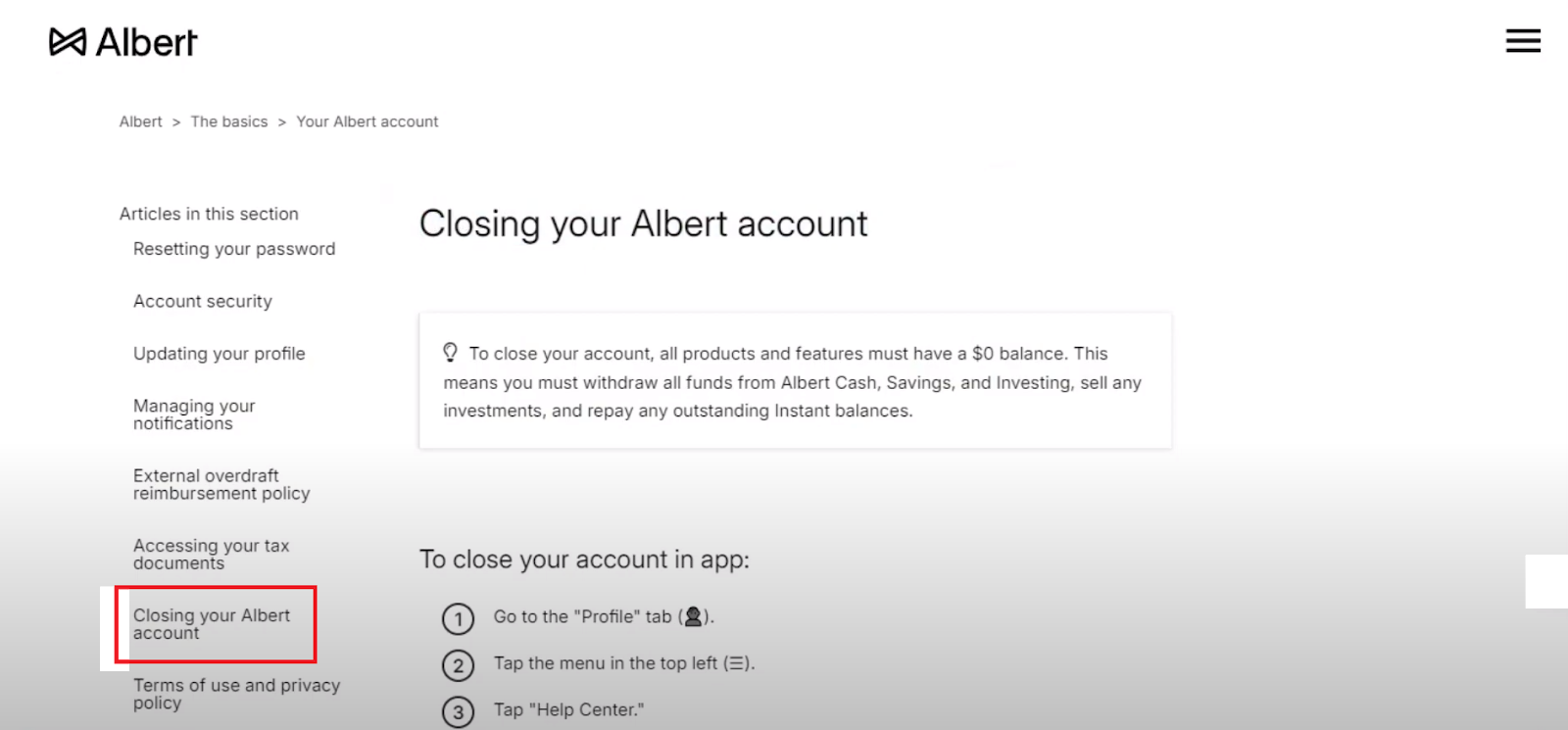

- After logging in go to the “Cosing your Albert account” option.

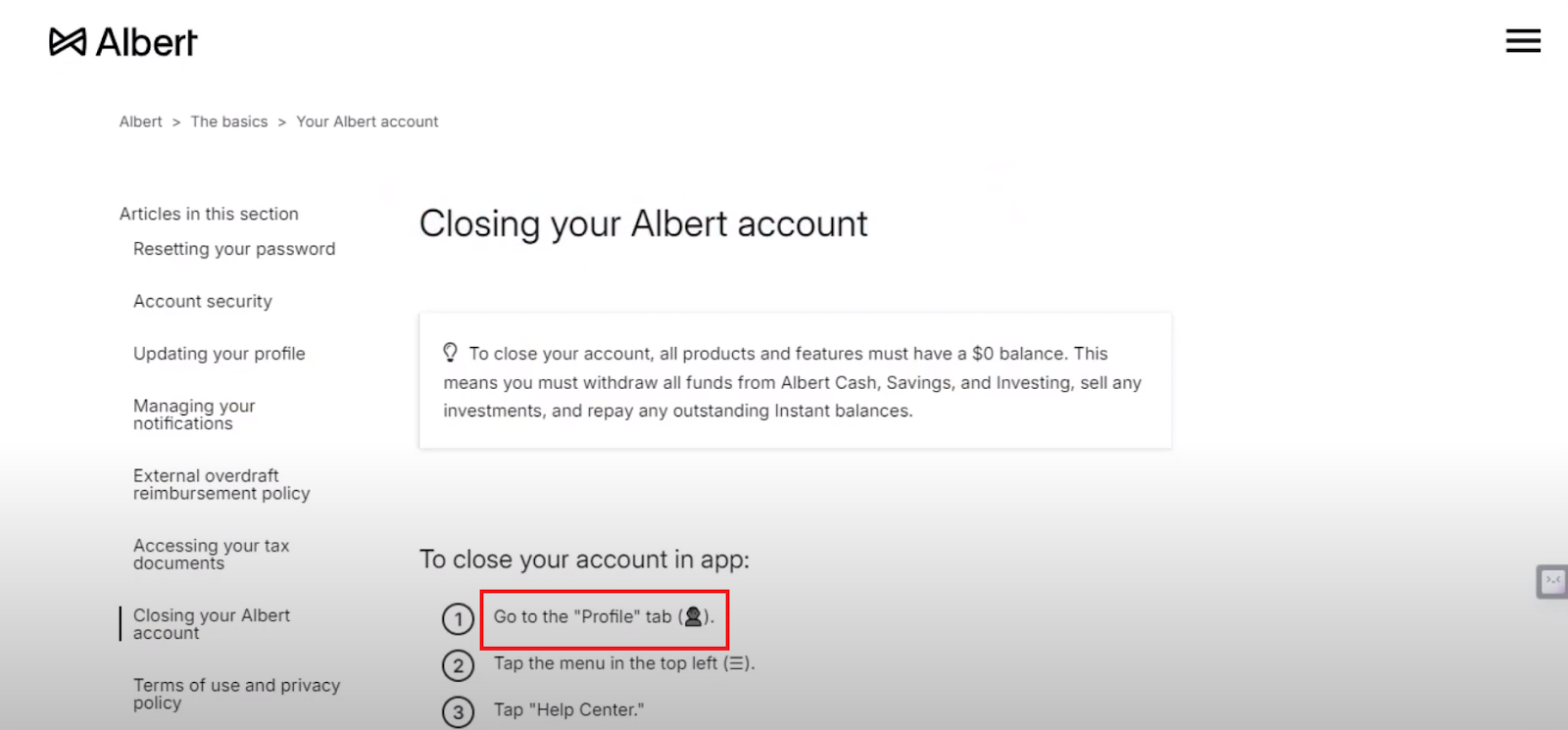

- After that, simply tap on your “Profile” tab on your account

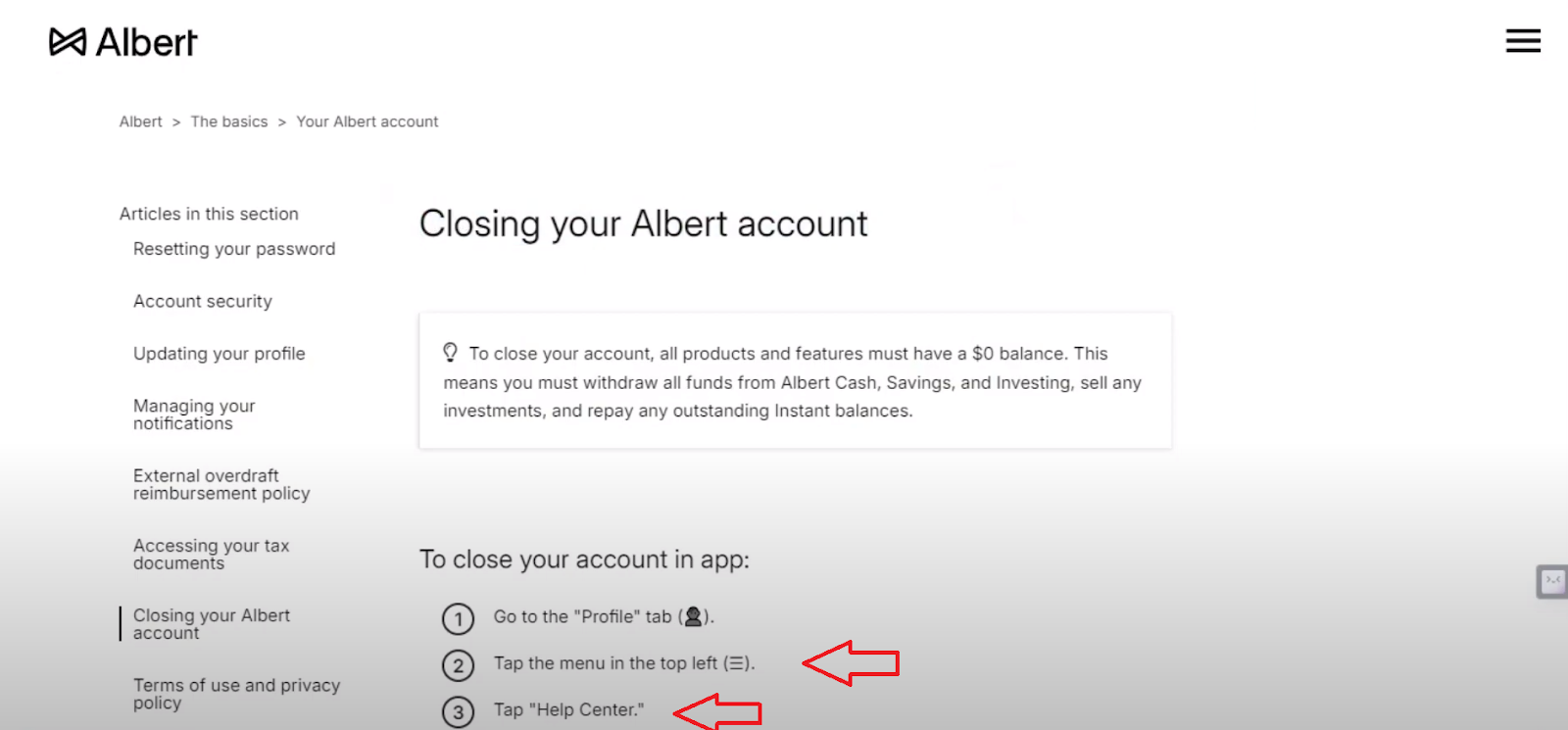

- Then navigate to the hamburger menu at the top left corner and tap on “Help Centre”.

- Now locate the subscription feature and click on “Close my account”. It will then ask you to confirm the closing of your account and approve it.

So this is how you delete your Albert account. Now know that deleting your account is a permanent process and it is not reversible.

Concerns About Account Deletion

When you delete the account, then you will not be able to get all of your account data back, like your bank account information, credit card numbers, and your past transactions. Thus, be cautious when backing up the information connected to your accounts.

Before deactivating your account, you must cancel any memberships, ongoing payments, and outstanding bills to avoid paying any unwanted prices.

You must close or disconnect any accounts you have linked to your Albert account with different banking organizations or companies to avoid problems in the future.

Improve Your Online Safety with PurePrivacy

PurePrivacy is an effective tool for increasing your online security by protecting your passwords and important information.

It simplifies access by putting data security and privacy first by providing you with a secure place to keep and oversee login credentials across multiple websites and applications.

How Does it Work?

Account Analysis

- PurePrivacy thoroughly scans your social media accounts to find any security gaps and privacy concerns.

- The research includes limitations on access, sharing information permissions, and profile exposure settings.

Personalized Security Levels

- Customers are free to select the level of protection that best suits their needs, privacy concerns, and personal interests.

- PurePrivacy provides specific guidance to strengthen account security by customizing its recommendations.

One-Tap Suggestions

- Because of PurePrivacy's simple-to-use interface, putting specified security measures into practice is simple.

- With just one swipe, you may instantly implement recommended adjustments to their social media accounts, simplifying the process of improving privacy settings and lowering the possibility of unapproved data exposure.

Security Features

Improved Privacy Settings

- With PurePrivacy, you may strengthen their social media privacy by detecting and fixing possible weaknesses in the setups of their accounts.

- You can lessen the chance of unwanted access to private data by effectively changing settings and permissions.

Fast Notifications and Updates

- Through PurePrivacy's frequent updates and notifications, stay updated on the most recent privacy features and settings on social media networks.

- This guarantees that you can quickly implement suggested security measures to protect your online presence and stay informed about new dangers.

Simplified Security Operations

- Handling social media privacy is made simple with PurePrivacy, which removes the uncertainty involved in figuring out complicated privacy settings on many sites.

- PurePrivacy reduces the effort of keeping strong privacy protections on a variety of social networking platforms.

Frequently Asked Questions (FAQs)

-

Why is Albert withdrawing money from my account?

These may appear to be charges, but they are funds being sent to your savings account. You can set up Albert to automatically transfer money from the bank account you linked to the savings section of the Albert app. If you prefer to save independently, you may always turn this function off.

-

Is the Albert app safe?

Albert is a reliable application. Sutton Bank, Coastal Community Bank, Axos Bank, and Wells Fargo, N.A. are among the FDIC-insured banks where Albert Cash and Albert Savings accounts are maintained. It's also one of the most well-liked cash advance applications available, and it includes SIPC protection that covers the financial component of everything.

-

What will happen if I don't pay Albert?

If your payment due date comes but you do not have enough money to pay back the loan, Albert is going to take out as much of the amount that was advanced so that you can afford to repay. This might happen in several transactions till the loan is completely returned.

-

Is Albert a cash-based app?

The Albert application is a renowned advanced money software that easily connects with the Cash App. It provides fast access to cash up to $250 without any extra costs or charges. Just download the Albert app, connect your Cash App account, and then apply for a cash advance to take advantage of Albert with Cash App.

-

Does Albert have a savings account?

By using the Albert app, you can safely put aside money and receive incentives on your savings account with the help of the Albert Savings service, which is offered by Albert Cash, LLC and Albert Corporation.

Closing Your Albert Account Has Become Easy

Even while Albert provides a useful tool for managing your finances, there might be a point when you don't want its assistance.

Fortunately, the procedure for deactivating your account has become simple through this blog. Just send an email, text, or tweet to Albert's support staff. Keep in mind that removing your account will erase all of your data for good, so set up a backup before doing this.

Take charge of your online identity and look into extra security precautions to safeguard your financial and other private information with the help of PurePrivacy.