Table of Content

- What is Bright Money?

- Why Should I Delete My Account from Bright Money?

- How to Delete Bright Money Account

- Delete Your Account Via Live Chat

- Delete Your Account Via Call

- Essential Things to Keep In Mind Before Deleting Account

- Is Bright Money a Safe Platform?

- Improve Your Online Privacy

- Frequently Asked Questions (FAQs)

- Secure Your Financial Information!

Bright Money provides an easy method to manage your money. If you have decided to leave Bright Money, deleting your account is simple.

This guide will help you through the processes required to close your Bright Money account and ensure a smooth transition.

What is Bright Money?

Bright is an AI-powered app that offers every consumer a debt-free option. It allows users to pay off all types of debt (credit card, student loan, auto loan) and creates customised credit products using Machine Learning.

Using artificial intelligence and machine learning techniques, Bright Money analyses its users' financial data. It can provide personalised details on their spending habits, budgeting, and general financial wellness.

The company aims to assist consumers in achieving financial wellness by providing tools and information to help them minimise financial stress, save money, and make sound financial decisions.

Discover if Your Most Critical Identifiers Have Been Exposed on the Dark Web

Receive timely alerts and actionable insights with PurePrivacy's Dark Web Monitoring.

Why Should I Delete My Account from Bright Money?

You can think about cancelling your Bright Money account for a few reasons.

A Better Fit

- You may have found an alternative money management product that better meets your needs.

- Bright Money has several features; however, another platform can provide a better overall experience for you.

Becoming Inactive

- If you no longer use Bright Money's services and do not intend to do so in the future, cancelling your account can help you declutter your financial apps.

- This will also avoid any potential security problems linked to dormant accounts.

Data Security Concerns

- If you are concerned about Bright Money keeping your financial information, you can delete your account to remove it from their site.

How to Delete Bright Money Account

Bright Money does not provide a direct option to delete the account, but we will provide you with every way to delete it. Here is how:

Delete Your Account Via Email

- You must compose an email to [email protected] to cancel your account and submit it.

- Ensure that the email is well composed and contains all the details of membership that will be needed to delete an account.

- Finally, hit the send button and wait for the customer service representative to respond.

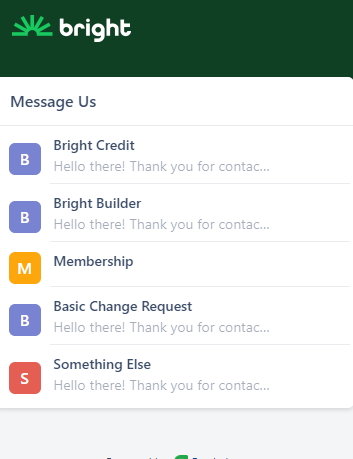

Delete Your Account Via Live Chat

- You also get a live chat option at the bottom right side of the screen.

- Click on it and get your account deleted by contacting the virtual team member through that option.

- Your matter will be considered, and they will help you with it.

Delete Your Account Via Call

- Just call the Bright Money customer service number at +1 877-274-6494.

- You must ask the team member to cancel your account.

- They will carry out a further process for deletion.

Essential Things to Keep In Mind Before Deleting Account

Before closing your Bright Money account, consider the following factors:

Download Important Data

- Download any crucial financial data saved in Bright Money, such as transaction history and budgets.

- It will not be recoverable once deleted.

Ongoing Payments

- If you have automatic payments set up with Bright Money, cancelling your account can disrupt these transactions.

- To avoid difficulties, update your payment methods.

Subscriptions

- Check whether you have any active subscriptions through Bright Money.

- These could be for premium features within Bright Money or subscriptions to the financial data services they control.

- Cancel them before deleting your account to avoid further charges.

Account Verification

- If you need future data on your Bright Money account history, such as for tax purposes, contact customer care before closing your account.

Consider Alternative Options

- Bright Money provides a specific set of features.

- If you are deleting your account because you have found a better fit, consider what features you value most in a money management tool.

- This will assist you select the best option when creating a new account.

Is Bright Money a Safe Platform?

While Bright Money claims to use bank-level safety precautions such as 256-bit encryption, it is vital to note that it is a financial technology platform rather than a bank.

This means that your money could not be secured by the FDIC. Furthermore, because Bright Money connects to your existing accounts, there is always the possibility of unauthorised access if your Bright Money login information is hacked.

Before considering whether Bright Money is the ideal platform for you, evaluate these aspects and Bright Money's security measures to your risk tolerance.

Using cyber security tools to keep your data safe can help! PurePrivacy comes with all the privacy-focused features to make you secure online.

Improve Your Online Privacy

PurePrivacy is your one-stop application for controlling your internet privacy. It lets you control the information you share on social media networks and with data brokers.

How It Protects Your Information?

View Removal Requests

- A user-friendly interface allows you to track the status of your data removal requests from data brokers.

View The Data Broker's Details

- Categorizes data brokers for quick access and review of the information they have about you.

Tracker Blocker

- It blocks recognized trackers from interacting with their domains, preventing them from collecting your data.

Whitelist Or Blacklist Trackers

- This feature allows you to customise the tracker blocker by whitelisting specific trackers that you think are safe.

Privacy Scan

- Determines the major risks associated with your PurePrivacy account based on feature usage.

Frequently Asked Questions (FAQs)

-

How can I cancel my Bright Money account?

You can cancel your application (request to close it) by contacting Bright's customer service team 24x7. Chat support is available through your Bright Money app or send an email at [email protected].

-

How do I cancel Bright Builder?

You can close your Bright Builder account through the Bright app or Customer Support. Bright will use your security deposit to pay any outstanding balance and then return the remaining amount to your associated checking account.

-

Does Bright Money offer you a loan?

No, Bright doesn't provide personal loans. But they can help you pay off your credit card debts faster. Bright Credit provides a low-interest line of credit designed to help you pay off your credit card debt quickly while avoiding excessive interest rates. It works similarly to a personal debt consolidation loan.

-

How long does Bright Money take to return the money?

You should receive your refund in 1 to 2 business days. They have also sent you an email regarding this. Please write to them if you need any additional support.

Secure Your Financial Information!

Follow the instructions for cancelling your Bright Money account. Download critical data, adjust payments and subscriptions, and confirm account details.

Consider using different money management tools and weighing the risks of linking your accounts. Consider privacy protection options such as PurePrivacy.