Chime is excellent in a lot of ways. It facilitates the speedy transfer of funds across accounts, for example, making it simpler to send or receive cash.

You will be able to transfer money to and receive money from friends and family who have Chime accounts. The fact that there are no additional costs is even better. But, even with these advantages, you might choose to discontinue using Chime at some point, especially if you no longer require it.

However, things can become a little difficult. You won't find a lot of help on the Chime website to assist you in deleting your account. Therefore, this blog will outline the simplest procedures for deleting a Chime account.

Key Takeaways

- To prevent further costs, unlink all accounts connected to Chime before deleting any individual accounts.

- Any money left over should be transferred to other accounts, such as PayPal or Cash App.

- Request the deletion of your account by emailing [email protected] to Chime, along with your account information.

- Call customer service at (1-844-244-6363) to inquire further about the account's current status and the expected time of deletion.

What Is Chime?

Chime offers hassle-free Internet banking without any monthly fees. Verifying, financial savings, as well as secured debit cards, are available with no minimum balance limitations.

Timely direct deposit, free-of-charge loans up to $200, 24-hour customer service, and no-fee quick transfers are among the benefits.

Chime's primary marketing channels are direct traffic (51.50%) and organic search (26.74%). Chime has over 14.5 million customers, of which 9 million use Chime as their primary account.

Who Is Chime Best Suited for?

Chime offers a few accounts with special features that make it a great option for a variety of users. You might find Chime useful if you:

- Are at ease doing all of their banking online without using physical venues.

- Make arrangements to get direct deposits.

- You want to create your credit without paying any fees or having a credit check.

- Would want a fee-free checking account that is simple to use.

- Would prefer not to squander cash on overdraft, ATM, or service fees.

If you want to optimize your interest earnings, Chime might not be the greatest option. There are numerous savings accounts available with 5% interest rates, even though the Chime Savings Account offers a competitive 2.00%¹ APY.

If I'm Not Using My Chime Account, Should I Close It?

If you created an account on Chime and found that you weren't using it as frequently as you expected, you may be wondering if it would be worthwhile to keep it open.

Keeping your account open won't do any harm because Chime is safe and free. It can be wise for you to close your unused account if you're worried about someone trying to take money out of it.

How to Delete Chime Account the Right Way

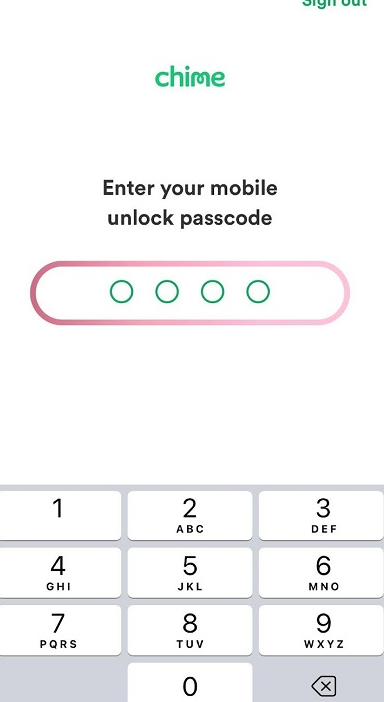

Step 1: Open the Chime application

- Closing your Chime account is easiest to do via the Chime app.

- On your smartphone, locate and launch the Chime app.

- Go ahead and input your PIN now in case you use it to further secure your Chime account.

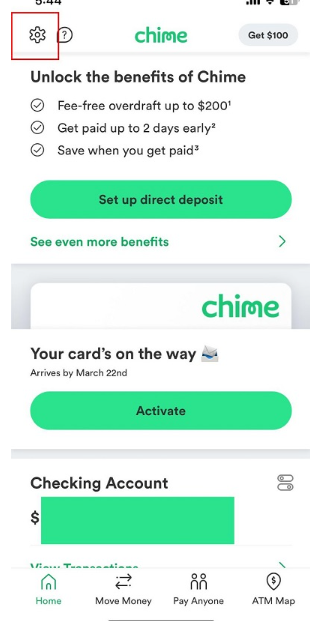

Step 2: Navigate to the Settings

- You will be on the home screen of the Chime app after logging in.

- In the top left corner of the screen, click the settings button.

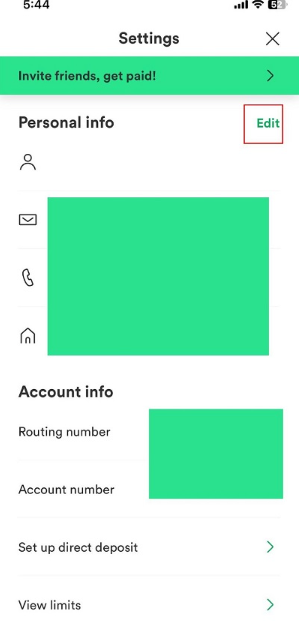

Step 3: Select Edit Next to Personal Information

- The Chime app's settings section can be accessed by clicking the settings button.

- You can close your account, view your account number, and check your app limitations here.

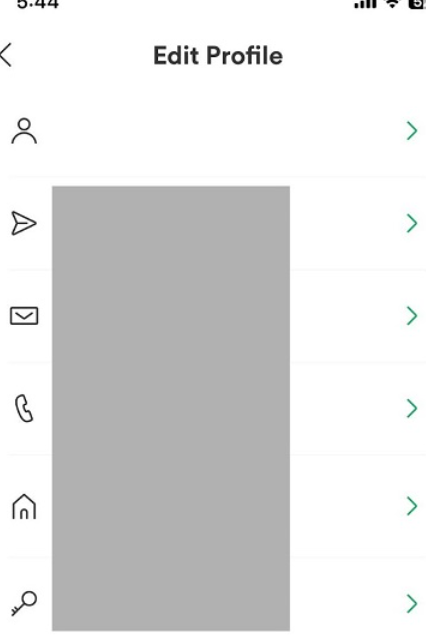

Step 4: Close your account

- When you scroll down to the bottom of the Chime App's Personal Info screen, you should see a button that says "Close my account" in easily readable in bright text.

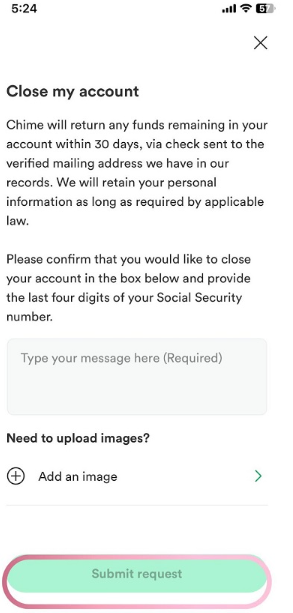

Step 5: Confirm That You Would Like to Close Your Account

- Although Chime's app makes it simple to cancel your account, they want to make sure you're not doing it by mistake.

- You must send a message to Chime customer care indicating you want to close your account to close it using the app.

- The final four digits of your social security number must also be entered.

Step 6: Get Your Money Via the Mail

- If you did not zero out your amount before terminating your Chime account, Chime will mail you the remainder of your balance within 30 business days via check to the address they have on file.

- If you did, the only thing you should get in the mail is any future tax records that Chime needs to send you.

When It Won't Be Possible to Remove a Chime Account?

Your account cannot be deleted until any overdraft balances are cleared first. If you are under scrutiny for something else, you won't be able to close the account until a decision has been made.

Furthermore, Chime will not delete the account if you are not the owner of the account or if you do not provide verification that you are the account holder.

Does Chime Work Well?

Although Chime is a fintech business rather than a bank, it might be a good fit for you if you're looking for a fully digital banking experience with low fees.

Chime is an acceptable option if you have been denied an account elsewhere because, unlike other banks, it does not run a credit check or review your ChexSystems record. However, by comparing online banks, you can find a greater selection of goods and services as well as higher APYs on savings accounts.

Protecting Your Online Presence with PurePrivacy

Everything you need in one convenient set to protect your online identity. It is critical to protect your personal information in the ever-changing digital environment.

You can take charge of your online persona with PurePrivacy and protect yourself against prying eyes, identity theft, and cyberattacks. Put your trust in us to deliver the best peace of mind and digital protection.

How Does It Operate?

Managing Social Media Privacy

Examine and pinpoint weak points in social media profiles to enhance privacy configurations.

Adaptable Security Settings

Adapt your security settings based on particular recommendations.

Suggestions with a Single Tap

Simplify your use of suggested security measures by applying them with a single tap.

Constant Updates

Learn about any new privacy options available on social networking sites as quickly as possible.

Tracker Blocker

By stopping third-party trackers from connecting with their websites and enhancing your online safety, tracker blockers safeguard user data.

Users can disable advertisements and receive security monitoring from other providers with the help of this application.

The Main components

Data security: Stop the exchange of information across domains.

Blocking websites and domains: Preserve your privacy by limiting access to specific websites and domains.

Frequently Asked Questions (FAQs)

-

Is Chime legitimate?

Yes. While not a bank, Chime's customer accounts are FDIC-insured through its partner institutions. It serves millions of consumers now, far more than any other online banking institution.

Chime's website validates compliance with numerous security frameworks and third-party validated certifications, including the Payment Card Industry Data Security Standard (PCI DSS) for credit card security.

-

Is Chime protected by FDIC?

In the case of a bank failure, The Bancorp Bank, N.A. or Stride Bank, N.A., Members FDIC, will cover all Chime accounts, regardless of ownership status.

-

What happens if my Chime debit card is stolen or used fraudulently?

Chime debit cards are protected by Visa's Zero Liability Policy, which means that if your card details are stolen, you won't be held accountable for any purchases.

-

Does Chime charge a fee?

There are no monthly fees, overdraft fees, debit card costs, in-network ATM fees, or foreign fees associated with using Chime's banking services. Nonetheless, you can still be liable for the following fees:

Over-the-counter withdrawals and out-of-network ATM usage cost $2.50.

For cash deposits at a Walmart or 7-Eleven, the amount ranges from $1 to $5.

Delete Your Account Safely And Enjoy

Chime account closure times vary based on how quickly support responds to your initial message. Before requesting the termination of your account, make sure you unlink all of your accounts and transfer any outstanding balances. Plus, to protect your private information online, consider using PurePrivacy.