Table of Content

Knowing your credit score is crucial. A high credit score influences your ability to obtain credit cards, loans, and in certain situations, rental accommodation.

Sadly, it might not always be easy to find your credit score. One option to overcome these difficulties is to get an Experian membership.

Don't worry about continuing to pay for an Experian membership if you aren't applying for anything that requires your credit score.

Learn how to remove your Experian membership by reading this blog which will also teach you how you can make your online presence safe with the help of PurePrivacy.

Key Takeaways

- You can use the Experian website to cancel your subscription online.

- You can also contact customer care over the phone.

- or by contacting the relevant support team via email.

- It's crucial to remember that canceling policies can change based on the strategy chosen.

What Is Experian?

Experian is an international data analytics and consumer credit reporting corporation based in Dublin, Ireland.

Experian gathers and compiles data on over 1 billion individuals and companies, including 235 million unique American consumers and over 25 million American companies. It is a component of the FTSE 100 Index and is listed on the London Stock Exchange.

Experian collaborates with the USPS to validate addresses. It is one of the "Big Three" credit-reporting organizations, along with Equifax and TransUnion.

Discover if Your Most Critical Identifiers Have Been Exposed on the Dark Web

Receive timely alerts and actionable insights with PurePrivacy's Dark Web Monitoring.

In What Ways Does Experian Determine My Credit Score?

Experian uses the data from your credit report to determine your credit score. This includes such things as:

- How frequently do you apply for credit

- The amount of debt you have

- Whether you timely make your repayments

- These details are used methodically by them to determine your credit score. Overall though, you get points for paying your bills on time and lose points for missing payments.

How to Delete Experian Account

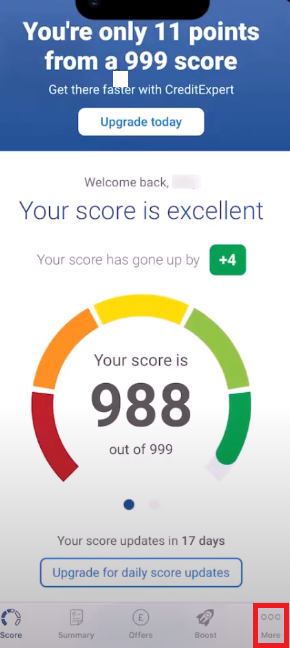

- First of all open up your Experian application and you will see this type of interface. Now click on the “More” tab on the bottom right-hand side of your screen.

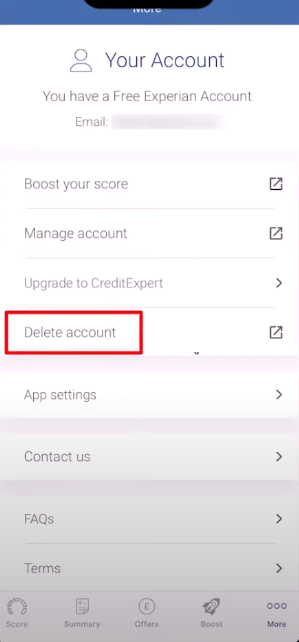

- After that, you will see all sorts of information and navigate to “Delete Account”, where you click on it.

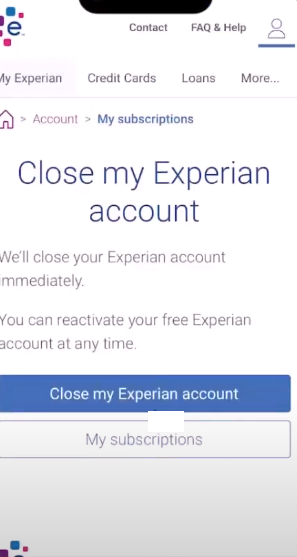

- When you click on the delete account it is going to open up a web address bar on Safari browser or Google browser depending upon what your default browser is and once you go to the page you will see the option called “Close my Experian account”.

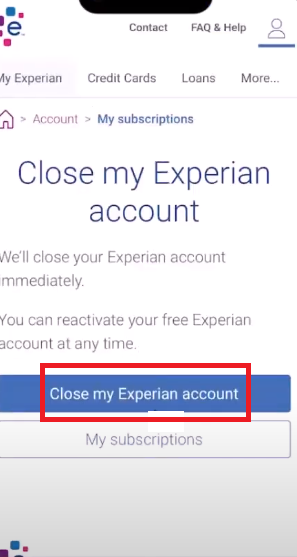

- All you have to do is click on “Close my Experian account” and that's how you delete your account.

Congratulations! You have successfully deleted your Experian account.

What is the Experian Credit Report?

The data that is listed on your credit file is displayed in your Experian credit report. The companies with whom you have held financial accounts are the source of this information. It also displays any information that is on file about you with the public registry.

Your credit report is available to you and the organizations with which you apply for credit. It assists in the decision-making process for lenders about loan approvals.

Does My Credit Report Allow Me to Make Corrections?

It is possible to fix mistakes on your credit report. If you happen to notice any mistakes, you must correct them. This is because lenders will utilize your credit record to inform their loan selections.

To correct the errors on your credit report, file a dispute with Experian. They can request more information from you, depending on the nature of the error.

If they are responsible for the error, they may go to the lender if needed. Experian will offer you their findings 28 days after they have completed their investigation of your complaint.

PurePrivacy Can Help You Improve Your Online Privacy

PurePrivacy is a complete solution for ensuring your privacy and security on prominent social media networks including Facebook, Twitter, and Instagram.

It gives customers a single location to evaluate and improve their account settings, offering personalized advice on how to reduce risks and shield private data from prying eyes.

How Does it Work?

Account Analysis

- Your social media accounts are thoroughly scanned by PurePrivacy to find any security gaps and privacy concerns.

- The research includes limitations on access, sharing information permissions, and profile exposure settings.

Personalized Security Levels

- Customers are free to select the level of protection that best suits their needs, privacy concerns, and personal interests.

- PurePrivacy provides specific guidance to strengthen account security by customizing its recommendations.

One-Tap Suggestions

- Because of PurePrivacy's simple-to-use interface, putting specified security measures into practice is simple.

- With just one swipe, users may instantly implement recommended adjustments to their social media accounts, simplifying the process of improving privacy settings and lowering the possibility of unapproved data exposure.

Security Features

Improved Privacy Settings

- With PurePrivacy, users may strengthen their social media privacy by detecting and fixing possible weaknesses in the setups of their accounts.

- Users can lessen the chance of unwanted access to private data by effectively changing settings and permissions.

Fast Notifications and Updates

- Through PurePrivacy's frequent updates and notifications, stay up to date on the most recent privacy features and settings on social media networks.

- This guarantees that users can quickly put suggested security measures into practice to protect their online presence and stay informed about new dangers.

Simplified Security Operations

- Handling social media privacy is made simple with PurePrivacy, which removes the uncertainty involved in figuring out complicated privacy settings on many sites.

- PurePrivacy reduces the effort of keeping strong privacy protections on a variety of social networking platforms.

Frequently Asked Questions (FAQs)

-

What are the drawbacks of Experian?

Experian's primary drawback is that, in contrast to FICO, it is not frequently utilized as a stand-alone tool for credit decision-making. Even lenders who do a thorough credit report analysis instead of relying solely on a borrower's credit score frequently examine information from all three bureaus, not just Experian.

-

Is owning an Experian account safe?

Experian links your bank accounts via a reliable third-party service and bank-level security. The Experian Boost and Personal Finances tools are powered by these largely secure URLs.

-

Why should I have an Experian account?

Your credit score is not included in credit reports. However, you can see both your FICO Score and your Experian credit report by having an Experian account.

-

Does having an Experian account influence your credit score?

Your credit ratings are unaffected by credit surveillance. Soft inquiries related to credit monitoring may show up on your credit reports, but they have no bearing on your credit scores.

Through AnnualCreditReport.com, Experian, TransUnion, and Equifax now provide free weekly credit reports to all American consumers.

-

What are the high-risk factors on Experian?

"Too high": Words like these that show up in your risk factors could mean that you have too much debt overall or that your outstanding credit card balances are lowering your scores and that you would benefit from lowering them.

-

How is your information used by Experian?

They gather the types of sensitive personal information and personal information about you. In the last 12 months, they have sold and released your personal information to third parties for business or commercial purposes, as further shown in the table below.

Take Control of Your Data With PurePrivacy

Experian is one of the biggest credit reference agencies in the United Kingdom. It gathers and handles data about customers and companies all across the world. Their collection of data creates your credit report.

Having mastered the art of Experian account deletion, you can now remove your account at any time. Install PurePrivacy right now to safeguard your data even further.

It operates in the background, keeps an eye on all of your activities, and protects against identity theft.