Table of Content

Are you thinking of closing your MoneyLion account? Whether you are no longer using the mobile features or cashback benefits, this guide will walk you through the process of permanently deleting your MoneyLion account.

What is MoneyLion?

MoneyLion is a private fintech company that provides loans, financial advice, and investing services to individuals. It was founded in 2013 and targets 70% of American consumers who mostly live paycheck to paycheck.

The company's mission is to enhance their users' money management and savings while enhancing their credit score. According to MoneyLion's website, more than 90% of its members are first-time investors.

Discover if Your Most Critical Identifiers Have Been Exposed on the Dark Web

Receive timely alerts and actionable insights with PurePrivacy's Dark Web Monitoring.

Why Should I Delete My MoneyLion Account?

Here are the reasons why you should delete a MoneyLion account:

Securing Personal Data

Deleting your account can reduce the amount of personal data that MoneyLion stores, which is important given the growing costs related to data breaches (the global average cost in 2023 was $4.45 million).

No Longer Using the Account

Deleting your MoneyLion account will help declutter your financial apps and save your money if you are not using any of its features like mobile banking, advances, and incentives.

How to Delete Your Account from MoneyLion

From the App

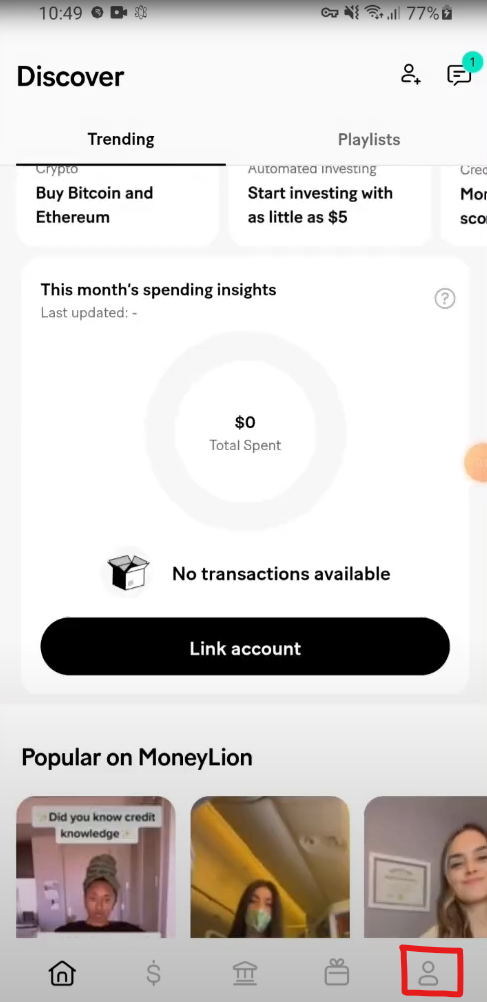

- First of all, open the MoneyLion application on your smartphone.

- Once you log in, tap on the profile icon which is located at the bottom right corner of the screen.

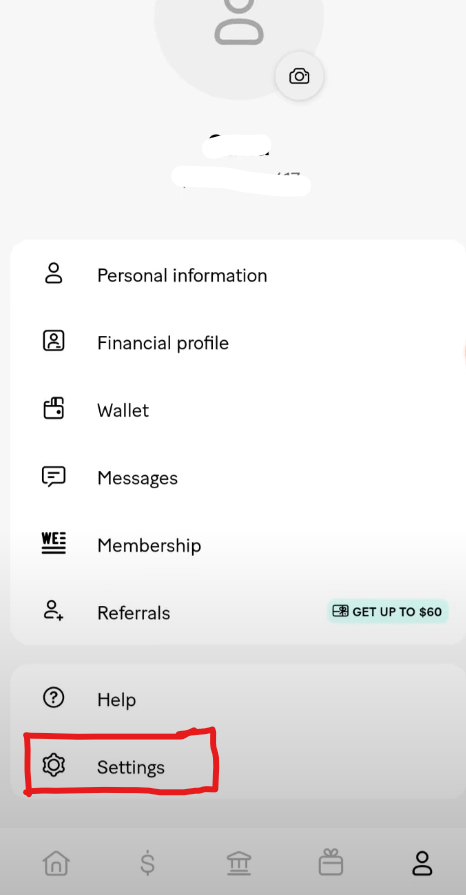

- Then tap on the Settings buttons.

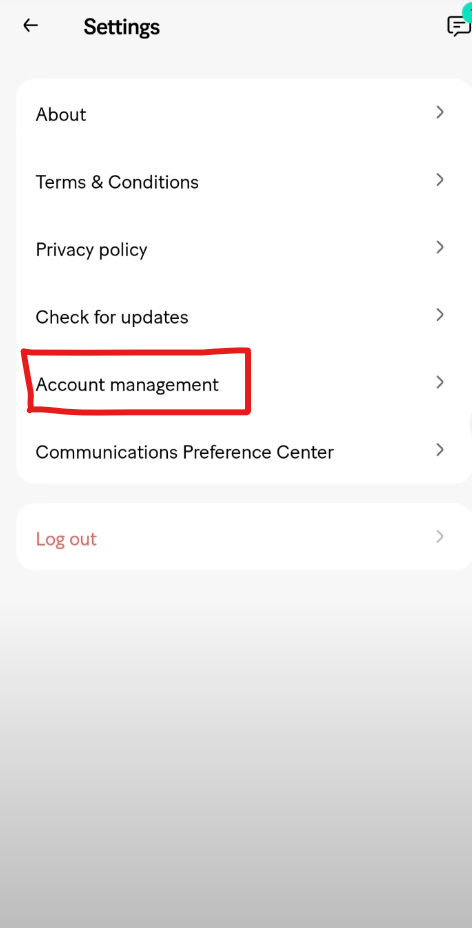

- Once you are on the settings page tap on the Account Management option.

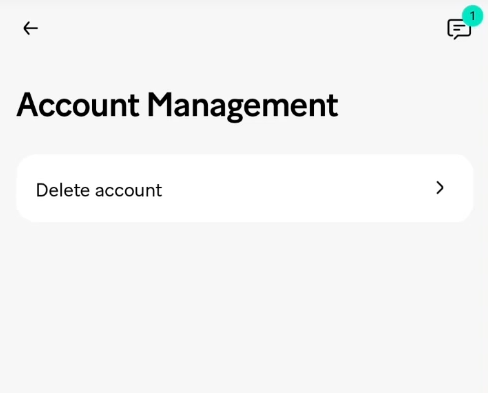

- After that tap on the Delete Account button and follow the instructions.

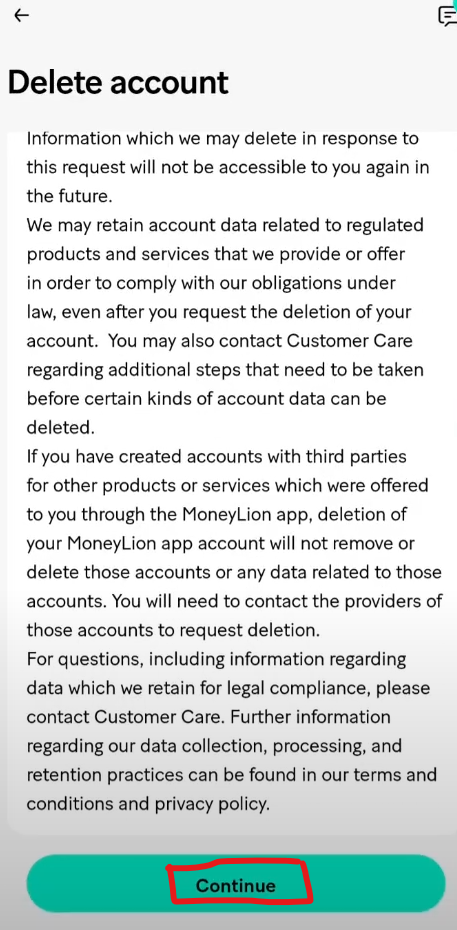

- Then read the instructions on the page and tap on the Continue button.

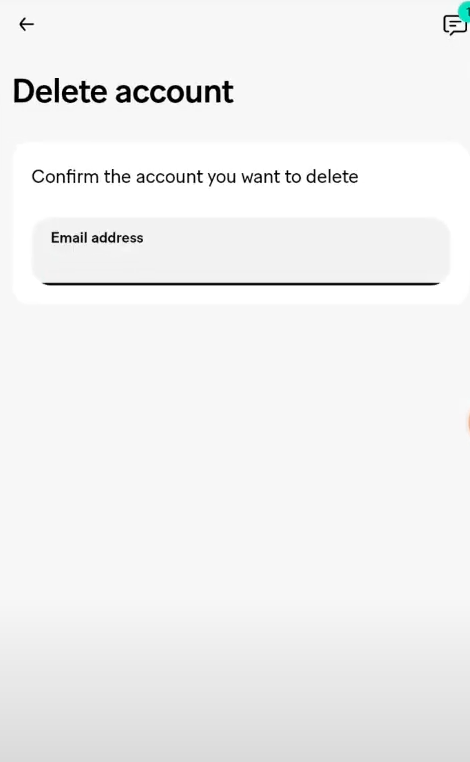

- Then confirm the account you want to delete by typing in your email on the next page.

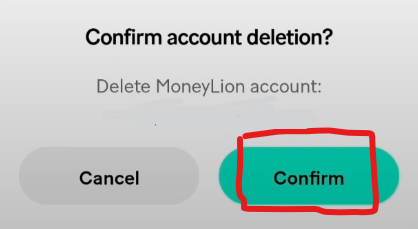

- Then you will see a popup notification on the screen, tap on the Continue button.

That is if you have successfully deleted your account from MoneyLion.

From the Website

- Log in to your account on the website.

- Click on your profile in the upper left corner.

- Click on 'Membership'.

- Select 'Manage My Membership'.

- Once your loan payments have been settled, you can proceed with cancellation.

From Emails

- Open your email account associated with the application or website.

- Now compose an email to [email protected].

- On the subject line, type REQUEST TO DELETE MY ACCOUNT.

- Now send them an email requesting that they delete your account from their database as well as any information you may have with them. This is an example of how to compose an email.

What Happens Once I Delete My Account from MoneyLion?

Here’s what happens to delete your MoneyLion account:

Loss of Access to Features

All of MoneyLion's features, such as their RoarMoney account, investment account, Credit Builder loans, and other perks associated with their membership program, will be lost for you.

Data Removal

You can remove your private information from MoneyLion, but you should check the Privacy Policy to confirm the whole process.

Unpaid Amounts

You are liable for covering any unpaid fees, Instacash advances, loans, or other expenses associated with your MoneyLion account.

Is MoneyLion a Safe Platform?

MoneyLion is a reputable platform that offers security features such as FDIC insurance for checking accounts and data encryption. However, there have been new concerns about their membership program and costs.

You have to consider both factors before making a decisive decision. Read a few reviews here to learn about their customer experiences, and be aware of any membership fees or loan terms before signing up.

But online platforms like MoneyLion are always at risk of hidden costs and data breaches. MoneyLion encrypts data, but breaches and data theft can still occur because the free plan has limitations.

When it comes to enhancing online privacy, consider using a holistic privacy solution like PurePrivacy.

- It assesses your settings on online platforms and social media sites to recommend privacy tweaks and limit publicly available information.

- It removes your data from multiple data brokers, minimizing the amount of information to platforms that are at risk of data breaches or targeting advertising.

Following are a few more benefits of using PurePrivacy.

Get Added Safety with PurePrivacy

PurePrivacy is a privacy app specifically designed to be your all-in-one solution for managing your private data, social media settings, and online privacy.

What Do You Get?

Auto-Scan Social Media Settings

Check your social media settings and get tailored recommendations on making privacy tweaks.

Remove Private Data

Use the Remove My Data option to send recurring opt-out requests to 200+ data brokers via the in-app dashboard.

Privacy Scan

Assess any major risks related to your social media accounts (Facebook, Instagram, Twitter X, and more) to enhance privacy posture.

Get a Risk Score

PurePrivacy can evaluate the level of danger related to the information that data brokers gather.

Frequently Asked Questions (FAQs)

-

Why am I unable to remove my MoneyLion account?

If you have a Credit Builder Plus loan, you will have to pay it off in full before MoneyLion cancels your membership. The best part is there is no penalty for early repayment!

-

How do I make my MoneyLion account disabled?

You can reach out to MoneyLion customer support at 888-659-8244 to disable the account, even if you want to keep using the app. The customer reps will entertain your inquiries or issues.

-

How do I delete a bank account from MoneyLion?

By tapping the three dots to the right of the Accounts tab screen, you can go to the More Options menu and disable a linked account from appearing in the tab. After that, choose Manage linked accounts and get rid of the ones you want to.

-

What happens if you do not pay MoneyLion?

Missed or late loan payments can seriously ruin your credit score if you have limited credit history. To minimize late payments, set up automatic payments to pay your Credit Builder Loan.

Invest Safely Online

Avoid potential fees and minimize data theft by carefully deleting your MoneyLion account.

This comprehensive guide has covered all the ways (email, website, and app) to delete your MoneyLion account.

For added security, consider using a privacy solution like PurePrivacy to control your online profile and reduce your data footprints from future breaches.