Table of Content

- What is Wealthfront?

- Why Is It Important to Delete Your Account from Wealthfront?

- How to Delete Wealthfront Account

- Essential Things to Consider Before Deleting the Wealthfront Account

- Is Wealthfront Considered a Safe Platform?

- Improve and Secure Your Online Identity with PurePrivacy

- Frequently Asked Questions (FAQs)

- Secure Your Finances by Deleting Your Account

Ready to take the reins on your investments?

Wealthfront, a popular robo-advisor, offers automated investment management, but sometimes you crave more control.

No problem! Closing your Wealthfront account is a straightforward process; this guide will walk you through it.

What is Wealthfront?

Wealthfront is an automated investing platform that offers a variety of brokerage account options, including IRAs and 529 plans, as well as expert-curated portfolios.

Passive investors can invest with little risk via trading ETFs, index funds, cryptocurrency trusts, portfolio lines of credit, and low-cost bond ETFs.

Why Is It Important to Delete Your Account from Wealthfront?

Deleting your Wealthfront account isn't always necessary. However, there are a few reasons you could consider it:

Concern with Outcome or Fees

If you are dissatisfied with Wealthfront's investment returns or believe the fees are too much, deleting your account might be a good idea.

Managing Investments Yourself

Perhaps you have gained confidence and understanding about investing and would like to handle your portfolio. Delete your Wealthfront account to gain control of your money and make your own decisions.

Merging Accounts

You could simplify your finances by merging your investment accounts with a different provider. This can help you manage your investments more effectively and provide a more complete picture of your overall financial situation.

Inactive Account

If you no longer use your Wealthfront account and have no plans to invest in the future, removing it can help you organise your finances.

How to Delete Wealthfront Account

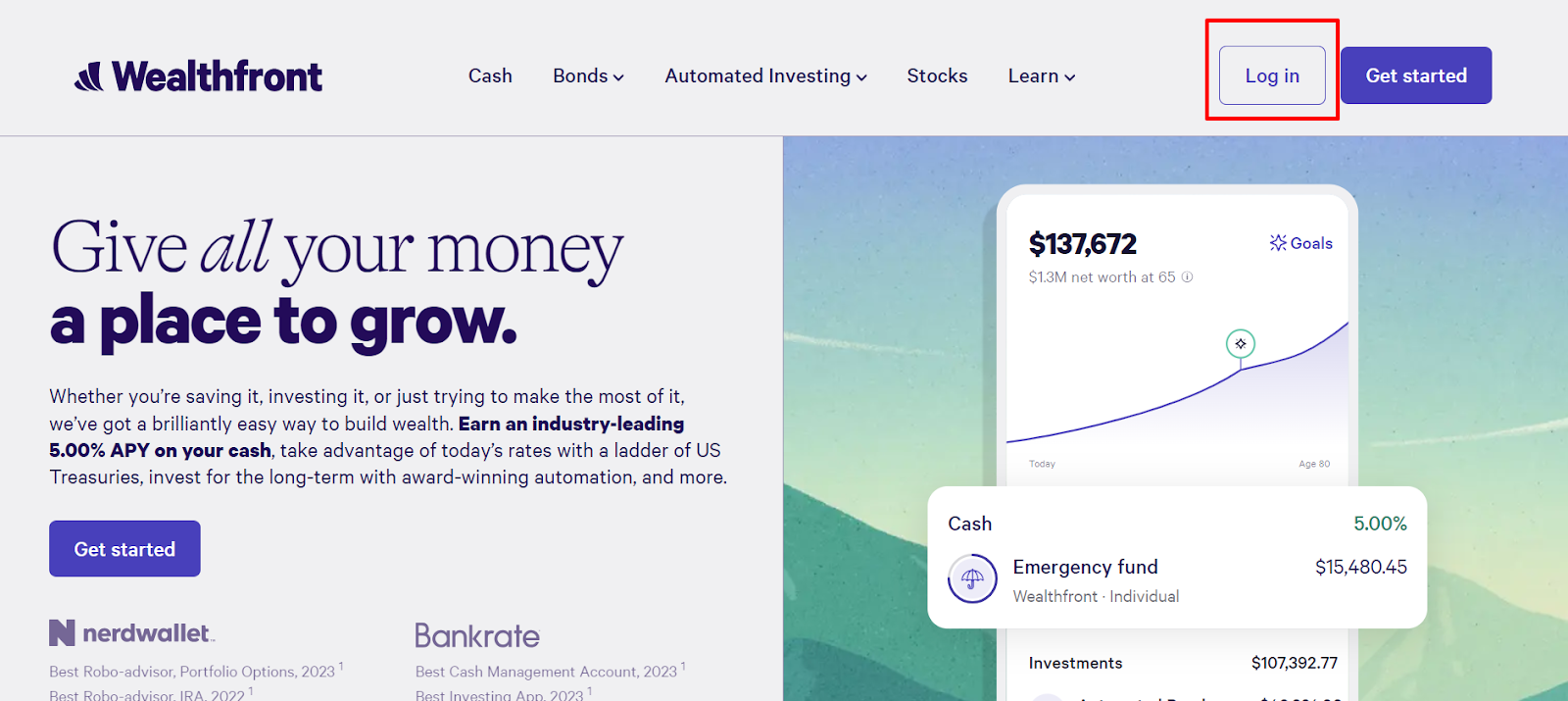

- Log in to your account on the Wealthfront website by clicking the Login button on the top right of the screen.

- Choose your Cash Account from your home dashboard by clicking or tapping it.

- In the top right corner, select the Manage option.

- Scroll to the bottom and select the Start account closure button.

- After that, follow the next instructions.

Essential Things to Consider Before Deleting the Wealthfront Account

Here are some key things to consider before cancelling your Wealthfront account:

Withdraw Any Remaining Funds

- You cannot access your money after the account is closed.

- Depending on your preference, Wealthfront will mail you a check or transfer the funds to your associated bank account.

Economic Gains Or Losses

- Selling investments in your account may result in capital gains or losses that affect your taxes.

- Wealthfront can offer tax documents to assist you with reporting.

- Consider talking to a tax professional for advice.

Back-Up Your Records

- Ensure you have copies of any account statements or tax documents you may require before closing the account.

- These records can be helpful for tax purposes or tracking your investment history.

Explore Alternatives

- Consider other investment options if Wealthfront's performance or costs do not meet your expectations.

- Contact a financial advisor for assistance.

Future Investing

- Consider whether you invest again.

- If so, keeping a little balance to avoid closing fees (if applicable) can be appropriate.

Is Wealthfront Considered a Safe Platform?

Wealthfront uses solid safety measures such as encryption and two-factor authentication to protect your information and investments.

However, no platform is completely risk-free. Potential security threats include scams that deceive you into disclosing login credentials, as well as problems in Wealthfront's systems that hackers could exploit.

To stay safe, avoid unwanted emails or phone calls, and only access your Wealthfront account via the official app or website.

For better safety PurePrivacy can detect data brokers who have your information and analyse the possible risks, enabling you to take measures to remove your data if needed.

Improve and Secure Your Online Identity with PurePrivacy

PurePrivacy is a data management application that allows you to control your internet privacy.

It focuses on improving and even cleaning up your digital footprints.

It can also assist you in removing your personal information from data brokers and identifying potential threats.

What PurePrivacy Offers?

Recommendations to Improve Privacy

- Receive personalised suggestions for improving your social media privacy.

- PurePrivacy highlights areas for improvement in your privacy settings.

- Recommendations help you through specific adjustments to improve your security.

Remove My Data

- Send data removal requests to supported data brokers.

- To start your requests, provide your personal information (name, email address, and country).

- Track the status of your requests using the PurePrivacy app.

View Removal Requests.

- Easily monitor the status of your data removal requests.

- View "Completed" and "In-Progress" requests in an easy-to-understand interface.

- Stay updated on the status of your data removal attempts.

Block Unknown Trackers

- Prevent recognized trackers from communicating with their domains.

- To establish blocking, enable a VPN on your device after getting authorization.

- This feature protects your internet activity from being traced.

Run a Privacy Scan

- Identify the key privacy concerns related to your PurePrivacy account usage.

- The feature assesses risk by analysing pending actions for each feature.

- This helps you identify areas where you might improve privacy settings.

Frequently Asked Questions (FAQs)

-

How can I unlink my account from Wealthfront?

When you link an institution with your login credentials, they display the accounts linked with those credentials and add them to your plan. To remove an account, navigate to your linked accounts page, uncheck Display, and include in my financial plan.

-

How do I liquidate my Wealthfront account?

Login and click the Transfer Money button at the top of the dashboard, then Withdraw, and finally, "Withdraw the entire account balance" to liquidate your account. You will get your cash by bank transfer (ACH). Please remember that taxes may be associated with liquidating your account.

-

Is the Wealthfront Cash Account risky?

Wealthfront is not a bank. Hence it offers the Wealthfront Cash Account through partnerships with various FDIC-insured institutions. While FDIC insurance typically limits you to $250,000 per person, Wealthfront stores your money in multiple banks, allowing you to be insured for up to $8 million per person.

-

Can I open two Wealthfront accounts?

Yes, you can have numerous Automated Investing Accounts on Wealthfront. Some of the clients may want to do this if they want to have separate portfolio allocations. In other words, you might have one account with a Wealthfront-recommended portfolio and another that is personalised.

Secure Your Finances by Deleting Your Account

While Wealthfront is an easy and automated investment platform, it can sometimes not fit your needs best.

This guide explains how to delete your Wealthfront account and the factors to consider.

Remember to withdraw funds, manage tax implications, look into alternative investment options, and use data privacy software like PurePrivacy to manage your online presence.