Table of Content

Cybercriminals are constantly lurking online, seeking to steal personal information, with bank account details being a primary target. In the first three months of 2024 alone, there has been a staggering 1,170% increase in targeted victims due to emerging data breaches. This growing threat highlights the need for stronger security measures to protect your financial information.

This blog provides crucial tips on safeguarding your personal data, particularly for PNC Bank and other financial institutions. By following the outlined strategies, you can defend yourself against hackers and scammers, ensuring your financial security remains intact in an increasingly vulnerable digital world.

How Does PNC Bank Get Your Data?

Your interactions with PNC Bank's services allow them to gather information about you. This includes information you voluntarily provide, such as when you apply for a loan or open an account.

Also, they gather information passively about your location and internet activities. Using this information, they can provide more individualized services, stop fraud, and make better products.

Types of Information PNC Bank Gathers

Like many other financial organizations, PNC Bank gathers client data to offer customized services and adhere to legal obligations.

Personal Information

When you use their products, login, fill out forms, or otherwise engage with them online, they gather the information you give them. Plus, they might monitor and document any correspondence you have with them via their website, mobile app, phone, email, chat, or postal mail.

Personal Data from Third Parties

To customize your online experience, they obtain information from outside sources such as credit bureaus.

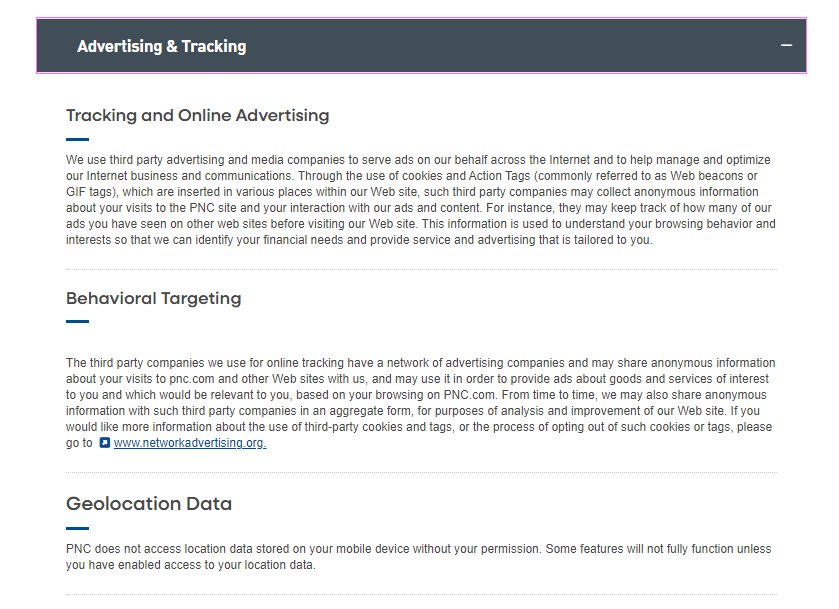

Data Compilation Via Other Technologies

They gather data for internal uses, such as analytics and tailored content, using cookies and click stream auditing technologies. They might also use these tools to run their websites, protect against fraud, and maintain security.

Why Is It Important to Understand PNC Bank's Privacy Policy?

PNC Bank collects, uses, shares, and protects your personal information according to its privacy policy. It is important to know about this policy for several reasons:

Protecting Your Personal Data

Understanding the kind of data that PNC gathers can help you understand the scope of their data collection methods.

By being aware of how PNC uses your information, you can ensure it meets your expectations and preferences.

Managing Data Exchange

Knowing with whom PNC shares your information might help you assess possible dangers and make sound choices.

Maintaining Privacy and Security Procedures

The policy should specify how PNC protects your information against unauthorized access, disclosure, alteration, and destruction.

Controlling your personal information can be easier if you know your rights under the policy.

Making Well-Informed Decisions

Understanding PNC's privacy practices will enable you to determine whether or not its policies satisfy your moral standards and degree of comfort.

Using Products and Services Effectively

By being aware of the policy, you can choose wisely using PNC's goods and services.

How to Protect Your Personal Information on PNC Bank

Consider implementing these account security techniques to secure your belongings and keep fraudsters far away.

Identify Typical Hacking Scams

Hackers attack bank accounts using various strategies. Avoid malware, brute-force attacks, phishing emails, and skimming devices.

Use Secure Password Practices

Make secure, one-of-a-kind passwords that are challenging to figure out. Use a mix of special characters, numerals, and capital and lowercase letters. For increased security, consider using a password manager.

Secure Your PIN (Personal Identification Number)

Never reveal your PIN to third parties. Avoid writing anything down and commit it to memory. Select a secure PIN and make frequent changes to it.

Protect Your Online Banking Devices

Use biometric authentication, remote wiping, strong passcodes, and device encryption. Also, update your device's OS and banking apps regularly.

Avoid Using Public WiFi or Out-of-Network ATMs

Avoid using public WiFi for banking purposes. Before using an ATM, look for indications of manipulation and select one in secure areas.

Protect Your Data from Identity Theft With PurePrivacy

PurePrivacy provides a comprehensive solution to boost your privacy and prevent identity theft. With PurePrivacy, you can take charge of your online identity and guarantee the security of your personal data.

- Dark Web Monitoring: Actively search the dark web for compromised personal data.

- Tracker Blocker: Protect your privacy from targeted advertising.

- Remove My Data: Remove personal information from data broker websites.

- Social Privacy Manager: Manage who has access to your messages, posts, and private data.

Scan the Dark Web

Get notified immediately if any of your data is found on the dark web so you can act quickly to limit the harm.

Avoid Invasive Tracking

Stop third-party trackers from tracking your online activities and gathering personal information.

Send and View Data Removal Requests

View the status of your data removal requests and track the progress of your privacy protection efforts.

Scan/Rescan Social Media Settings

Analyze your social media privacy settings and spot any weaknesses, enabling you to strengthen your online security.

Scan the Dark Web for Your Data

Check the dark web with Dark Web Monitoring for compromised data. You will get alert notifications immediately if any of your sensitive information is discovered.

Send Recurring Opt-Out Requests

Use the Remove My Data option to get a customized risk evaluation highlighting security vulnerabilities, and get your publicly available data removed from 200+ data brokers.

Block Online, Invisible Data Tracking

Use the Tracker Blocker to enhance your privacy and stop targeted advertising by blocking third-party trackers and cookies.

Get Added Privacy With Social Privacy Manager

Use Social Privacy Manager to prevent your search history from being recorded or sold to third parties by automatically erasing it.

Frequently Asked Questions (FAQs)

-

How can I keep my PNC account safe?

Here are the steps to assist with account protection:

Establish a PNC-specific password and user ID. Never conduct PNC banking using the same username and password as any other website.

Configure PNC Alerts.

Make secure passwords. -

Can I lock my PNC account?

Easy Lock can stop cash advances, withdrawals, and new transactions using your card. Additionally, PNC credit cards can be used with it. You can find more details and video instructions for PNC Easy Lock here.

-

Is PNC Bank safe?

Yes, it is safe to use because the Federal Deposit Insurance Corporation (FDIC) recognizes PNC Bank as a member. Most commercial banks and savings associations offer account insurance to their depositors up to the insured amount through the FDIC.

-

How do I keep my PNC account hidden?

Follow these steps on the Account Preferences page:

If you wish to hide an account, click or tap it.

Click or tap on Visibility under Details.

You will be prompted with a pop-up screen asking to confirm; select Hide.

Wrapping Up!

Protecting personal information on PNC Bank is essential. You can greatly lower the risk of unwanted access by using strong passwords, turning on 2FA, and scanning account activity.

Consider using PurePrivacy with a VPN to reduce the risk of hackers and scammers from accessing your data by blocking unwanted sites, enhancing the privacy and security of your data.