Table of Content

- What is Zelle?

- Why Is It Important to Remove the Phone Number from the Zelle Account?

- How to Remove Your Phone Number from Your Zelle Account

- Things to Consider Before Removing Phone Number from Zelle

- Is Zelle Considered a Secure Platform?

- How to Take Control of Your Privacy Online

- Frequently Asked Questions (FAQs)

- Take Care of Your Online Privacy

Zelle provides a simple way to send and receive money directly between friends, family, and even businesses.

But what happens when you change your phone number? Leaving your old phone number linked to Zelle can be a security concern.

This guide will help you remove your phone number from Zelle, ensuring that your account remains secure and that your money transfers are delivered to the correct recipient.

What is Zelle?

Zelle is a digital payments network founded in the US that is operated by a private financial services firm owned by Bank of America, Truist, Capital One, JPMorgan Chase, PNC Bank, U.S. Bank, and Wells Fargo.

The Zelle service allows customers to electronically transfer money from their bank account to another registered user's bank account (inside the United States) via a mobile device or a partner financial institution's website. There is no fee or charge for this transaction.

Why Is It Important to Remove the Phone Number from the Zelle Account?

You should remove your old phone number from your Zelle account for various reasons.

Enhance Data Safety

- If your old phone is lost or stolen, someone might be able to get to your Zelle account if your phone number is linked.

- Many financial institutions use text message verification as a security feature.

- Thus a bad actor using your phone could gather these codes and potentially take over your account.

Ensure Accuracy

- To ensure that your money transfers reach the intended recipient, you must have your current phone number associated with your account.

- Zelle uses phone numbers or email addresses to identify receivers.

- Therefore using an outdated number may result in mistakenly sending money to the wrong person.

Update Your Account

- Having an old phone number on your account can be problematic for both you and the recipient of your money transfer.

- If you try to send money using your phone number, Zelle might send it to the previous one if it remains linked.

- This could cause frustration for both you and the recipient.

How to Remove Your Phone Number from Your Zelle Account

Remove the Phone Number from Zelle Through Chase

- First of all, open your Chase application on your smartphone or iPhone.

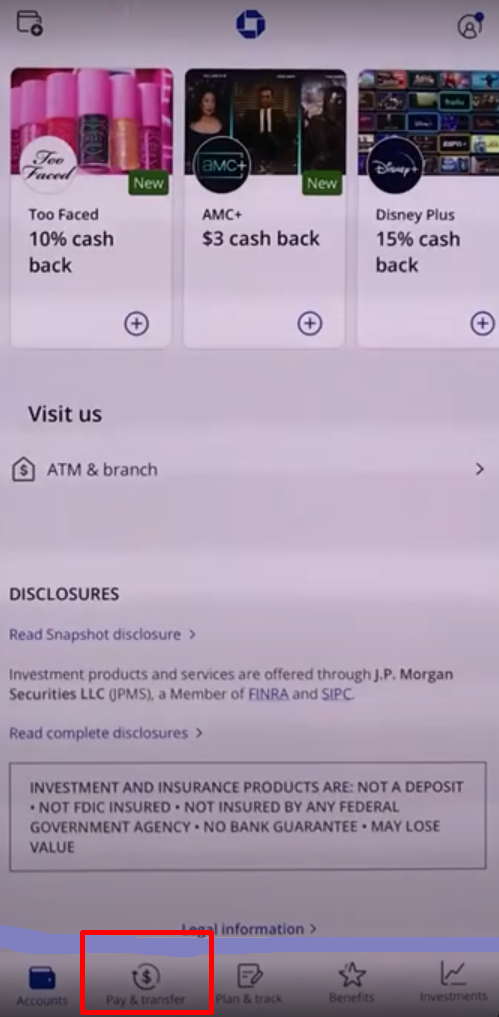

- After that on the homepage tap on the Pay and Transfer option at the bottom of the screen.

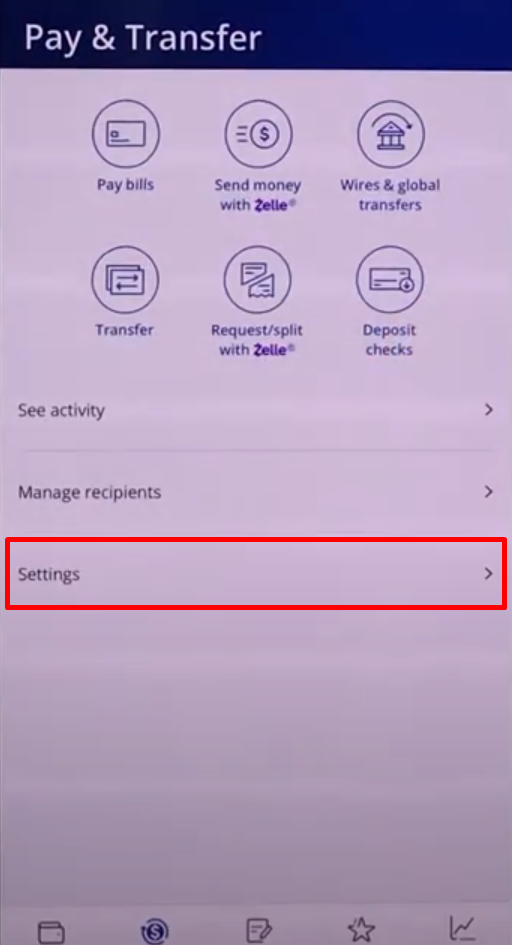

- Then tap on the Settings option on the next page.

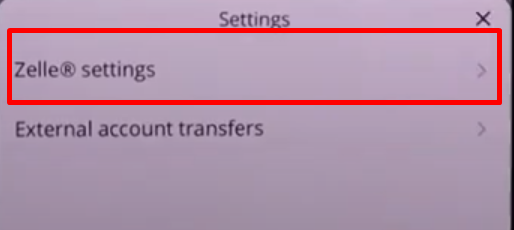

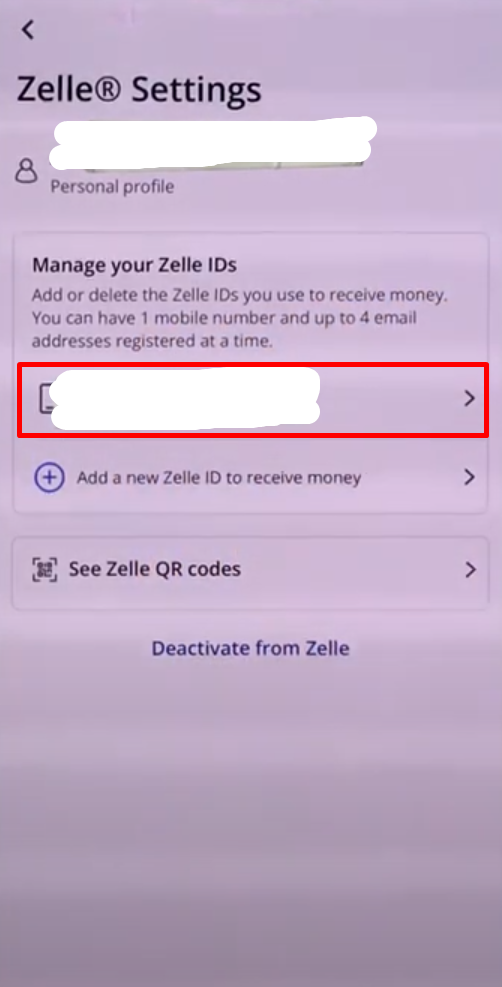

- Then tap on the Zelle Settings option from the popup message.

- Then tap on your phone number on the next page.

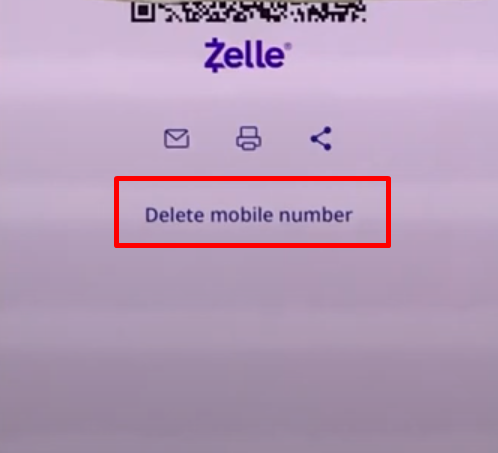

- Then on the next page tap on the Delete Mobile Number button.

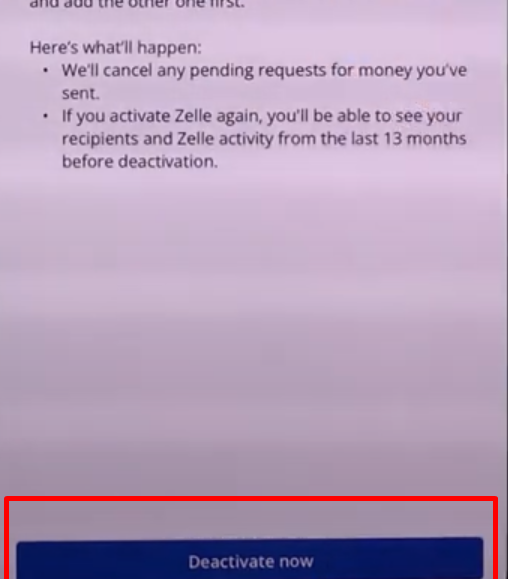

6. Then tap on the Deactivate Now button in the bottom of the screen to confirm.

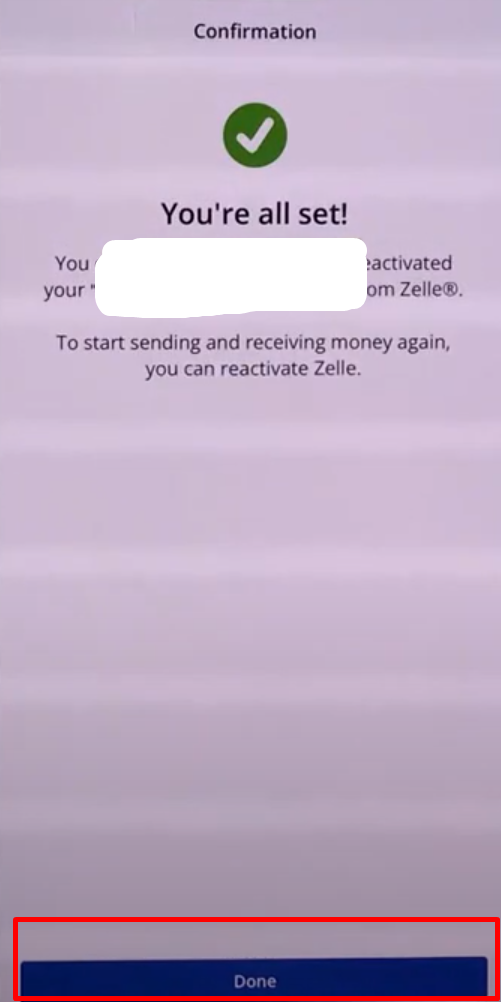

- After that tap on the Done button at the bottom of the screen.

Unenroll Your Mobile Number Or Email Address Via Online Banking

- Choose Transfer & Pay, Send & Request Money with Zelle®, and Preferences.

- Choose the mobile number or email address you want to unenroll.

- In the pop-up, click Unenroll, then Save.

Things to Consider Before Removing Phone Number from Zelle

Here are some things to consider before going to remove phone number from Zelle:

Verification

- Many banks use your phone number to verify your identity when you log in, change your account information, or send big sums of money.

- Removing your number completely can make it difficult to carry out these actions in the future.

Account Deactivation

- As previously mentioned, certain banks require at least a single contact (phone or email) to receive transfers.

- Removing your phone number could result in the deactivation of Zelle functionality.

Future Use

- Even if you are not using your previous number right now, you may get it back later.

- Leaving it associated with your account (but not as the primary number) can be useful if you ever need to regain access.

Is Zelle Considered a Secure Platform?

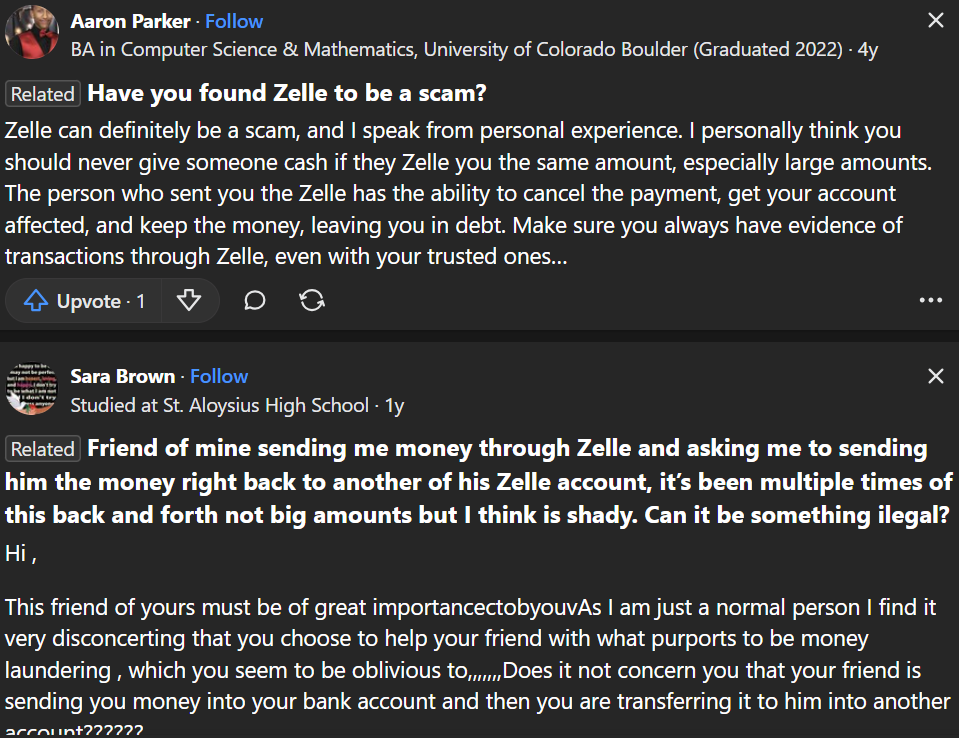

Zelle offers ease, but there are security compromises. While it uses encryption and fraud detection, security issues still exist.

Scammers can deceive people into giving money through phishing scams or fake online marketplaces.

Unlike credit cards, Zelle transactions are often final, which means there is no built-in protection against authorised transfers going to the wrong person or scammers.

This makes it critical to remain attentive and only give money to persons you know and trust. Read customers' reviews to learn more about the safety concerns.

However, don't worry, PurePrivacy can help by protecting your social media accounts, which scammers frequently exploit to target victims.

By identifying unsafe privacy settings and providing data removal options, PurePrivacy can help you manage your online privacy and make you a less attractive target for scammers seeking to take advantage of Zelle.

How to Take Control of Your Privacy Online

PurePrivacy is a powerful digital safety platform that allows you to control your online privacy and protect your personal information.

How PurePrivacy Manages Your Safety?

Delete Your Search History

- This function allows you to easily remove your search history across different social media networks.

- PurePrivacy safely deletes your search history, which helps maintain confidentiality and improves your overall privacy.

Auto-Delete Personal Posts

- PurePrivacy allows you to take control of your shared content.

- You can hide posts, limit visibility to yourself, or permanently erase them from the social media platform.

- This allows you to protect your privacy by hiding sensitive posts or removing them from public view.

Get a Risk Score

- PurePrivacy calculates a risk score to evaluate the potential hazards to your data kept by data brokers.

- This score is calculated by carefully reviewing the data brokers' privacy rules and removing sensitive material.

Frequently Asked Questions (FAQs)

-

How do I delete the phone number using US online banking?

1. Choose Send Money, then Preferences.

2. Find the information to be unenrolled, then click Choose enrolled number or Choose enrolled email.

3. Select the radio button next to the information you want to remove.

4. You will see a pop-up asking if you wish to unenroll. Select Yes or No. -

Can I use the same phone number for two Zelle accounts?

Yes, however, you must enrol each bank account with Zelle® using a different email address or US phone number. Because this is a unique identifier that tells them where to deposit or transfer funds, you'll need a unique email address or U.S. cell number for each account you open with Zelle®.

-

Why does Zelle not accept my phone number?

Your mobile phone or email address may already be associated with a bank or credit union that offers Zelle®. To register with a different bank or credit union or in the Zelle® app, your cell number or email address must be deleted from the original registration.

-

Can I get money from Zelle without a bank account?

Zelle requires a bank account to send and receive funds, although you may be able to sign up using some prepaid Visa or Mastercard debit cards. Unfortunately, not all prepaid debit cards are compatible with Zelle, but cards that require a phone number, billing address, and email address will function best.

Take Care of Your Online Privacy

While removing your previous phone number from Zelle may appear simple, it's important to assess the security benefits against potential downsides.

Protect yourself with Zelle by taking precautions and utilising PurePrivacy.

It helps to reduce your digital record and makes you a less accessible target for scammers.