Table of Content

- What is Bank of America?

- How Does Bank of America Get My Information?

- Why Is It Important to Opt-Out of Bank of America?

- Step-by-Step Guide on How to Opt-Out of Bank of America

- Steps to Opt-Out Using PurePrivacy

- Manual Opt-Out Method vs. Opt-Out With PurePrivacy

- Frequently Asked Questions (FAQs)

- Protect Your Information from Identity theft!

This year, millions of people's personal information has been exposed to data breaches.

Reports show that over 36 billion records have been compromised worldwide.

Everyone needs to protect their information and stay safe.

Follow this guide to opt out of Bank of America to protect your online privacy and personal information.

What is Bank of America?

Bank of America is a huge bank in the US that helps lots of people and businesses with their money. It started a long time ago in 1904 and now it's really big, offering things like checking accounts, saving money, helping people invest, and more.

It has lots of places where you can go in person and also lets you do things online.

How Does Bank of America Get My Information?

Online Interactions

When you use Bank of America's online banking platform or mobile app, your interactions and activities are logged. This includes logging into your account, viewing balances, making transactions, and communicating with customer service representatives.

Third-Party Sources

Bank of America may obtain information about you from third-party sources for various purposes, such as identity verification, credit assessment, and marketing. These sources may include credit bureaus, public records, marketing databases, and data brokers.

Cookies and Tracking Technologies

When you visit Bank of America's website or use its online services, cookies, and other tracking technologies may be used to collect data about your browsing behavior, device information, and preferences. This helps in personalizing your experience and improving service quality.

Understanding how Bank of America collects information about you can help you protect your privacy better.

Why Is It Important to Opt-Out of Bank of America?

Here's why opting out matters:

Protecting Privacy

By opting out, you can control how much information Bank of America collects about you and how it's used. This helps minimize the risk of unauthorized access, identity theft, and intrusive marketing.

Preventing Data Misuse

Your personal information is valuable, and its misuse can lead to financial fraud, identity theft, and other forms of cybercrime. Opting out helps reduce the likelihood of your data falling into the wrong hands.

Reducing Targeted Marketing

If you opt out of certain data collection, you'll get fewer ads from Bank of America and others. This means a banking experience that's more about you and less about ads.

Step-by-Step Guide on How to Opt-Out of Bank of America

You can choose what information you share with others and how much marketing you get. Bank of America gives you simple ways to tell them your preferences:

Submitting the "Set your privacy choices" form on the Bank of America website typically allows you to customize your privacy preferences regarding how the bank can use and share your personal information.

You can choose to limit some types of marketing and data sharing by the bank, giving you control over how your information is used.

By Phone

Call them toll-free at 1.888.341.5000

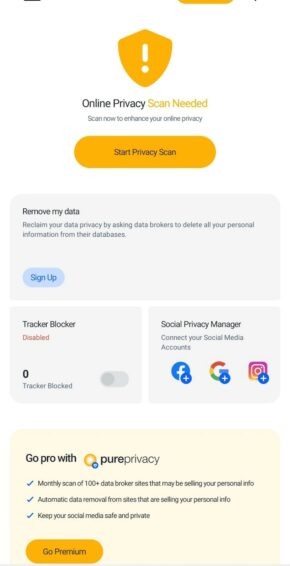

Opting out of such websites is not enough, you need more privacy. PurePrivacy makes it easier to remove your data from those platforms.

Platforms like Pureprivacy offer strong tools to help you keep your information safe and sound online.

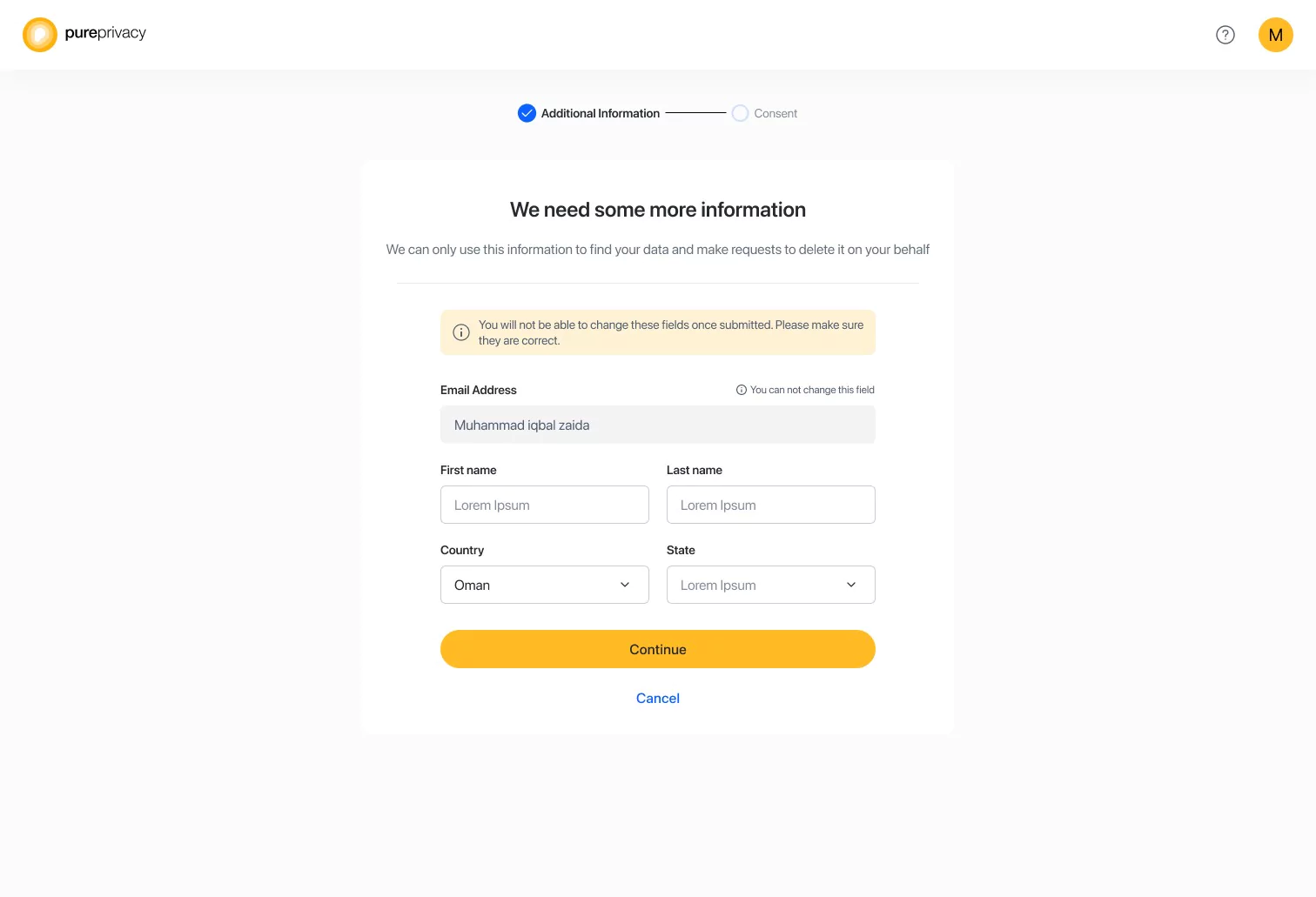

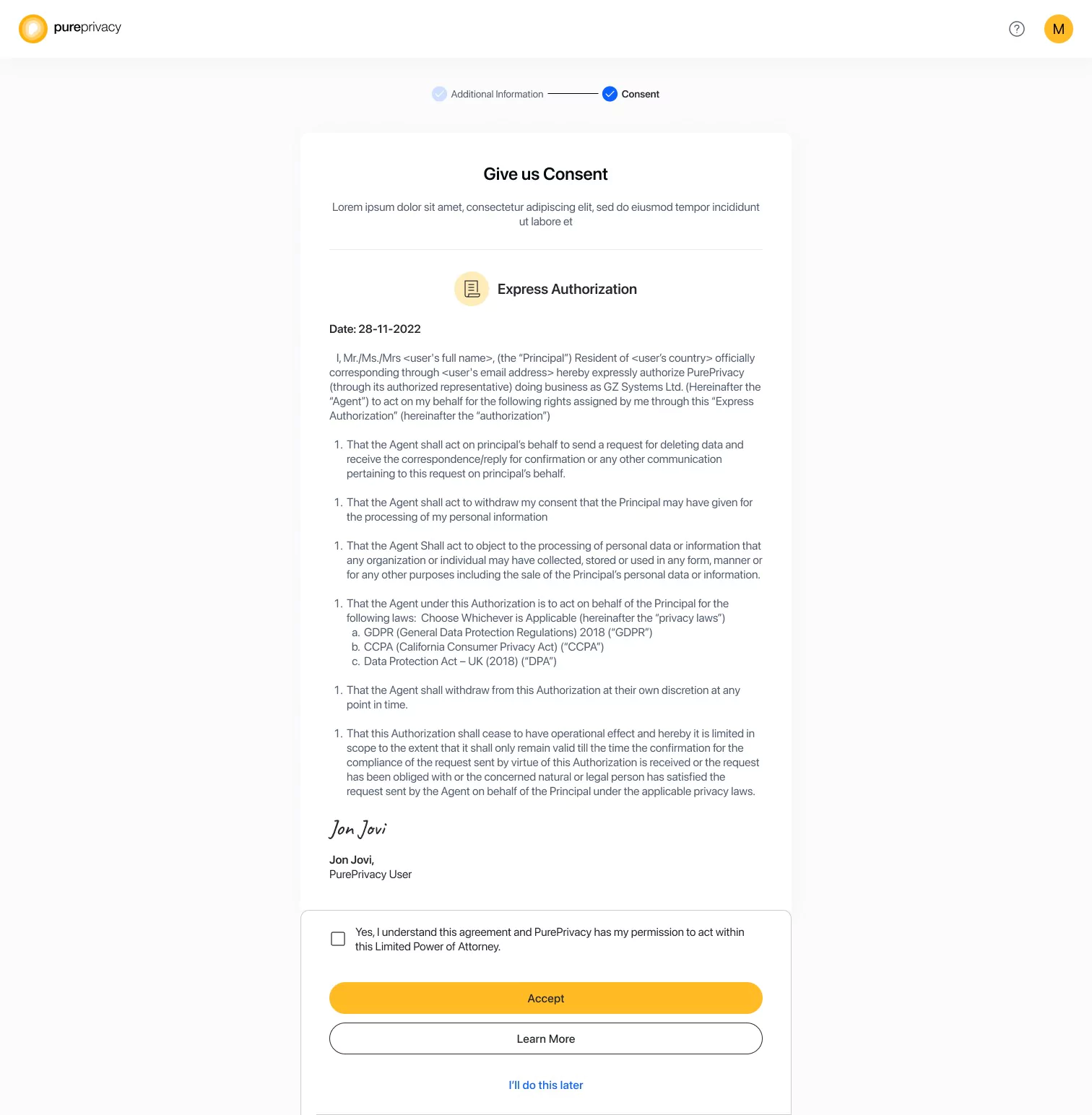

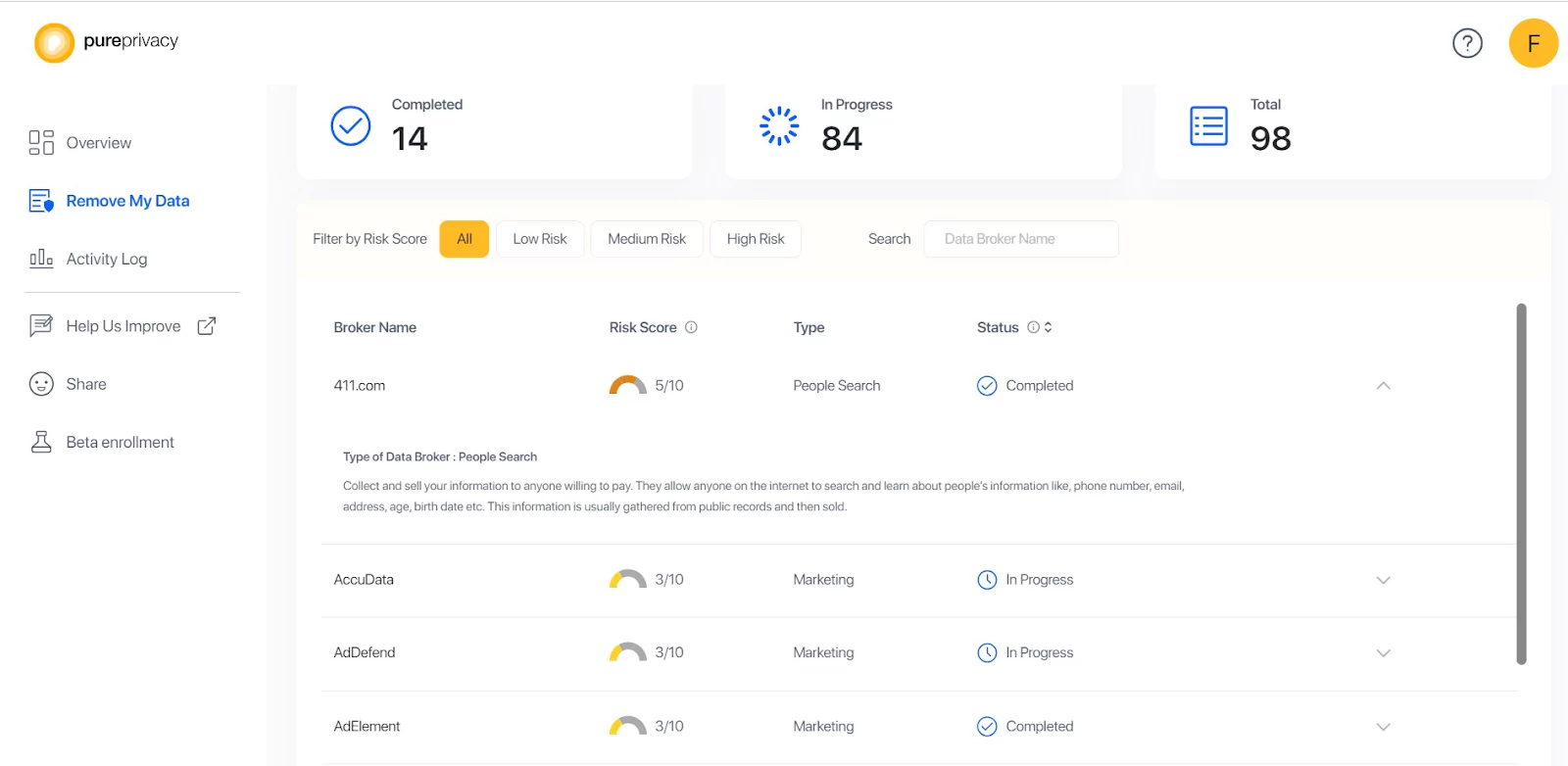

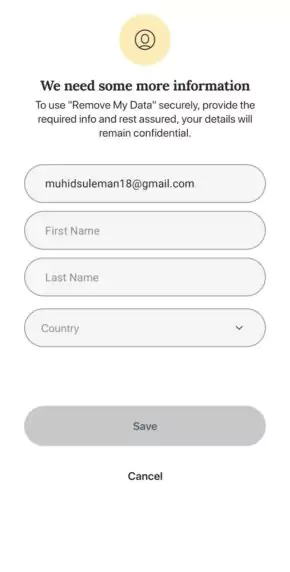

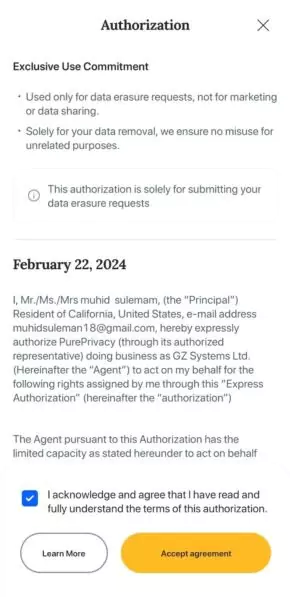

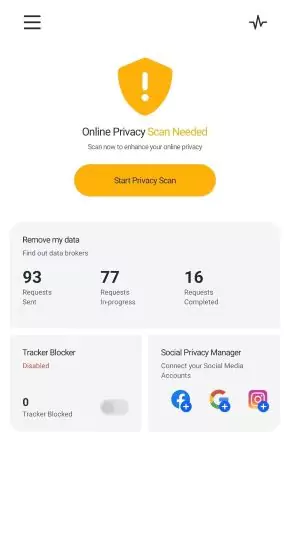

Steps to Opt-Out Using PurePrivacy

Manual Opt-Out Method vs. Opt-Out With PurePrivacy

- You talk directly to Bank of America to opt-out, which might take time.

- You might have to give personal information to the bank.

- It could be a bit complicated and take time.

- You have to keep track of any changes yourself.

- Only relies on Bank of America's system.

- PurePrivacy does it for you automatically, without talking to the bank directly.

- PurePrivacy needs only basic information initially.

- PurePrivacy makes it simple and quick.

- PurePrivacy keeps you updated on changes automatically.

- Uses PurePrivacy's tools to boost privacy beyond what the bank offers.

Frequently Asked Questions (FAQs)

-

How secure is my personal information with Bank of America?

Bank of America uses strong security measures like encryption to protect your personal information. They have policies in place to keep your data safe and private, but it's still important to be careful and follow good security practices.

-

Can Bank of America share my personal information with third parties?

Yes, Bank of America can share your personal information with third parties, but they have strict rules about how and when they do this. You may also have options to limit certain types of sharing.

-

Can I remove my information from Bank of America to protect my privacy?

You can't completely remove your information from Bank of America if you still have an account, but you can limit how they share your data. For better privacy protection, try PurePrivacy. It helps you remove your information.

-

What are the risks of having my information on Bank of America?

Keeping your information with Bank of America could mean someone might access your account if they get your login details. There's also a small risk of data breaches, but Bank of America tries hard to prevent them. Just be careful and follow good security practices.

Protect Your Information from Identity theft!

PurePrivacy makes it easy to keep our information safe online.

It's simple to use and provides everything we need to protect our data.

With PurePrivacy, we can control what information we share and feel more secure online.