Table of Content

Your information is at risk of being compromised! 87% of people leave information exposed online.

As we rely more on the internet, keeping our personal information safe online is getting trickier. Our digital stuff, like emails and bank details, can be used by bad people.

So, it's important to focus on keeping our online accounts secure and watching out for any problems to keep our private info safe.

By opting out of TransUnion, you can address this issue and enhance your data security and privacy.

Key Takeaways

- Opting out of TransUnion allows you to exert greater control over who can access your credit information, reducing the risk of unauthorized access and potential breaches.

- By limiting access to your credit report, you can minimize the chances of identity theft and fraudulent activity involving your personal and financial information.

- Opting out can help reduce the amount of unsolicited offers for credit and insurance products, providing a more streamlined and tailored experience based on your preferences.

- Taking control of your TransUnion profile empowers you to actively protect your financial reputation and privacy online, fostering a sense of security and confidence in your digital interactions.

What is TransUnion ?

TransUnion is one of the major consumer credit reporting agencies. It collects and maintains information on consumers' credit histories, which includes credit accounts, payment history, and other financial data. This information is used by lenders, creditors, and other businesses to assess an individual's creditworthiness when making decisions about lending money or extending credit.

How Does TransUnion Collect Your information?

TransUnion's information collection process involves sourcing data from lenders, creditors, and public records. From these financial entities, they receive updates on your credit activity, encompassing details such as account balances and payment histories.

This ongoing flow of information ensures the accuracy and timeliness of the credit reports generated by TransUnion. Plus,, they access public records, including bankruptcy filings and tax liens, to provide a comprehensive snapshot of your financial history.

By tapping into these diverse data streams, TransUnion builds detailed profiles used by businesses and individuals alike to evaluate creditworthiness and make informed financial decisions.

How does TransUnion share your information?

TransUnion needs to share your data with authorized entities like lenders, creditors, employers, landlords, and other businesses that have a legitimate purpose under the Fair Credit Reporting Act (FCRA). They may also disclose information to you directly upon request, as well as to government agencies in compliance with legal requirements.

Additionally, TransUnion may share data with third-party service providers who assist in activities like credit monitoring, identity verification, and fraud prevention. However, they do not sell personal information for marketing purposes without your consent.

Why Opt-Out of TransUnion?

Control Over Data Sharing

Opting out from TransUnion provides you with greater control over who accesses your credit information. By restricting TransUnion from sharing your data with certain third-party companies for marketing purposes, you can minimize the number of unsolicited offers or advertisements you receive.

Privacy and Security

Opting out helps safeguard your privacy and personal information, reducing the risk of identity theft or fraud. By limiting the dissemination of your credit data, you can mitigate potential vulnerabilities and maintain greater control over the security of your financial information.

Empowerment and Control

Overall, opting out empowers you to take charge of your financial privacy. It allows you to assert greater control over how your credit data is used and shared, enabling you to make more informed decisions about who can access your information and for what purposes.

How to Opt-Out of TransUnion the Right Way

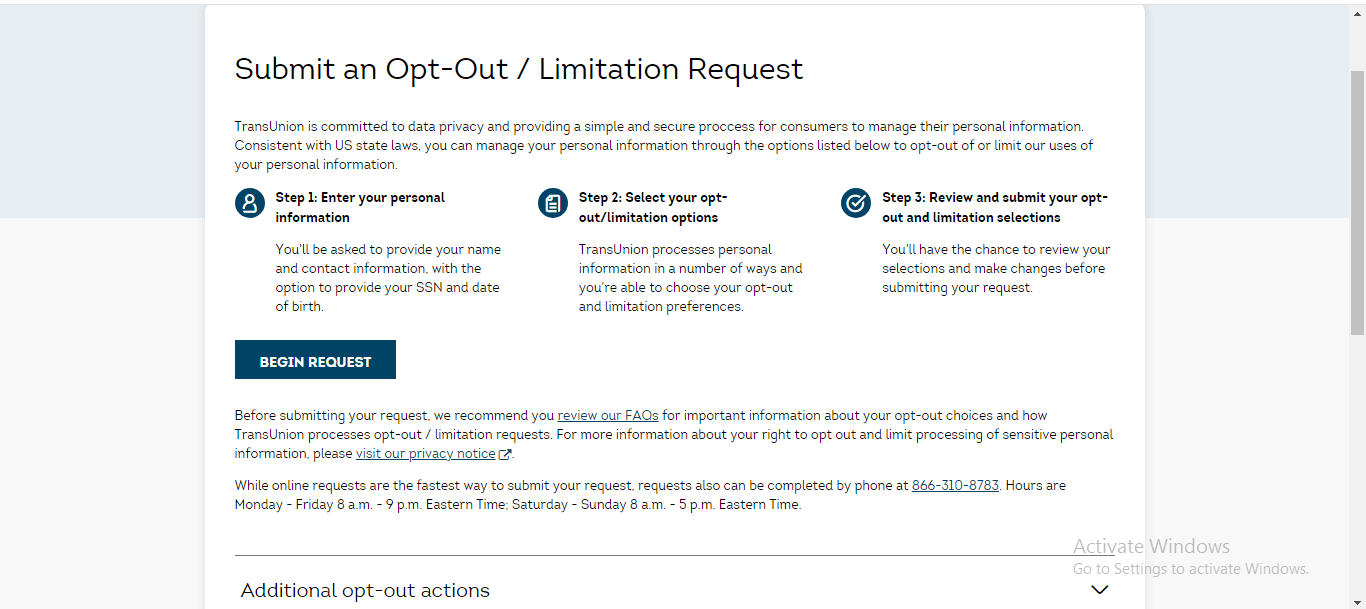

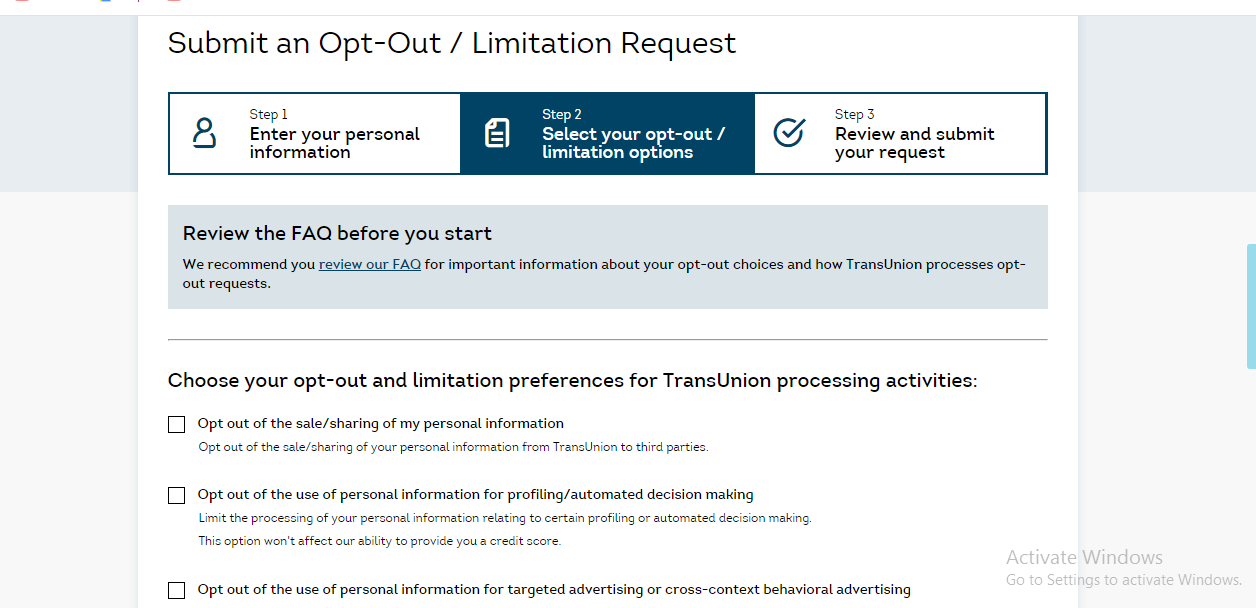

- Access their online form https://www.transunion.com/

- Scroll down to the bottom, go to the option terms of use and select the option “Your privacy choices”

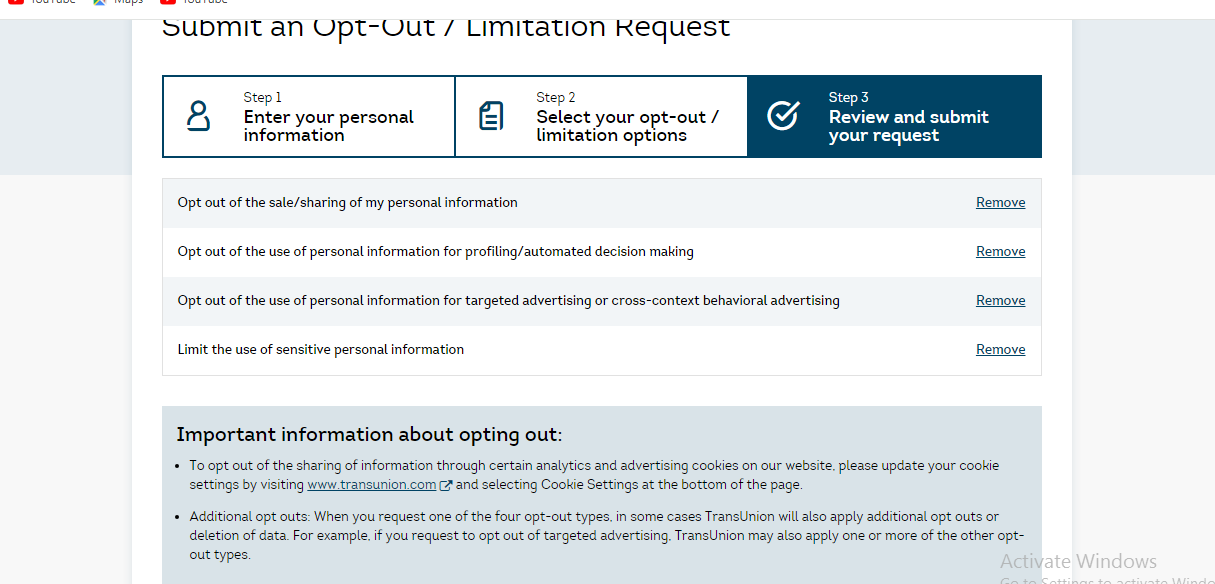

- You'll be required to perform 3 steps to opt out. In step 1, you have to provide your state, first name, last name, state, zip code, and dob.

- In step 2, you have to choose your opt-out preferences for TransUnion processing activities.

- In step 3, you have to review and submit your request.

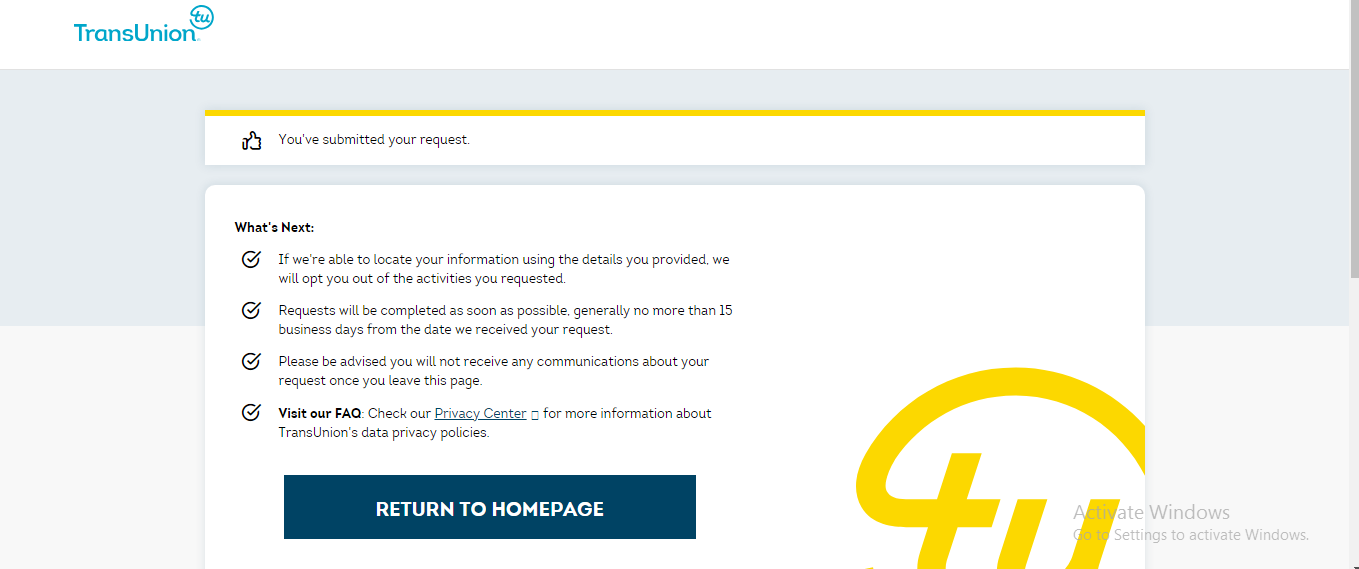

It may take a while for your request to be removed.

And, that's how you can opt-out of TransUnion.

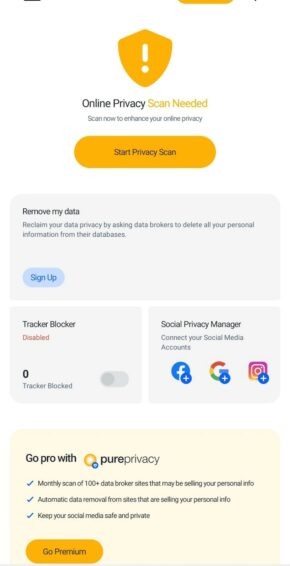

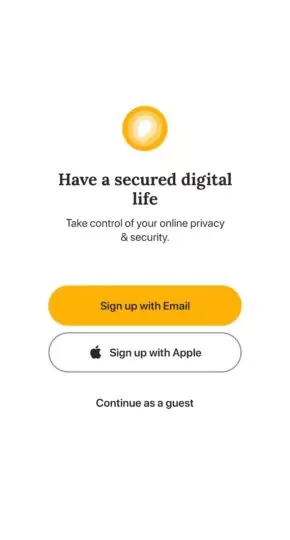

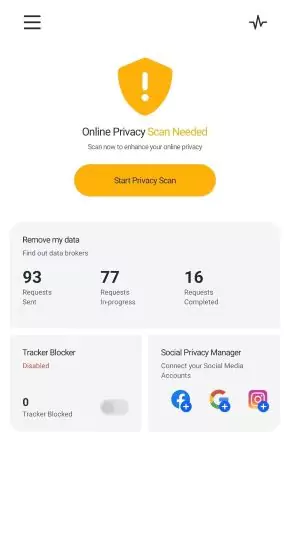

Opt-Out of Multiple Data Brokers Using PurePrivacy

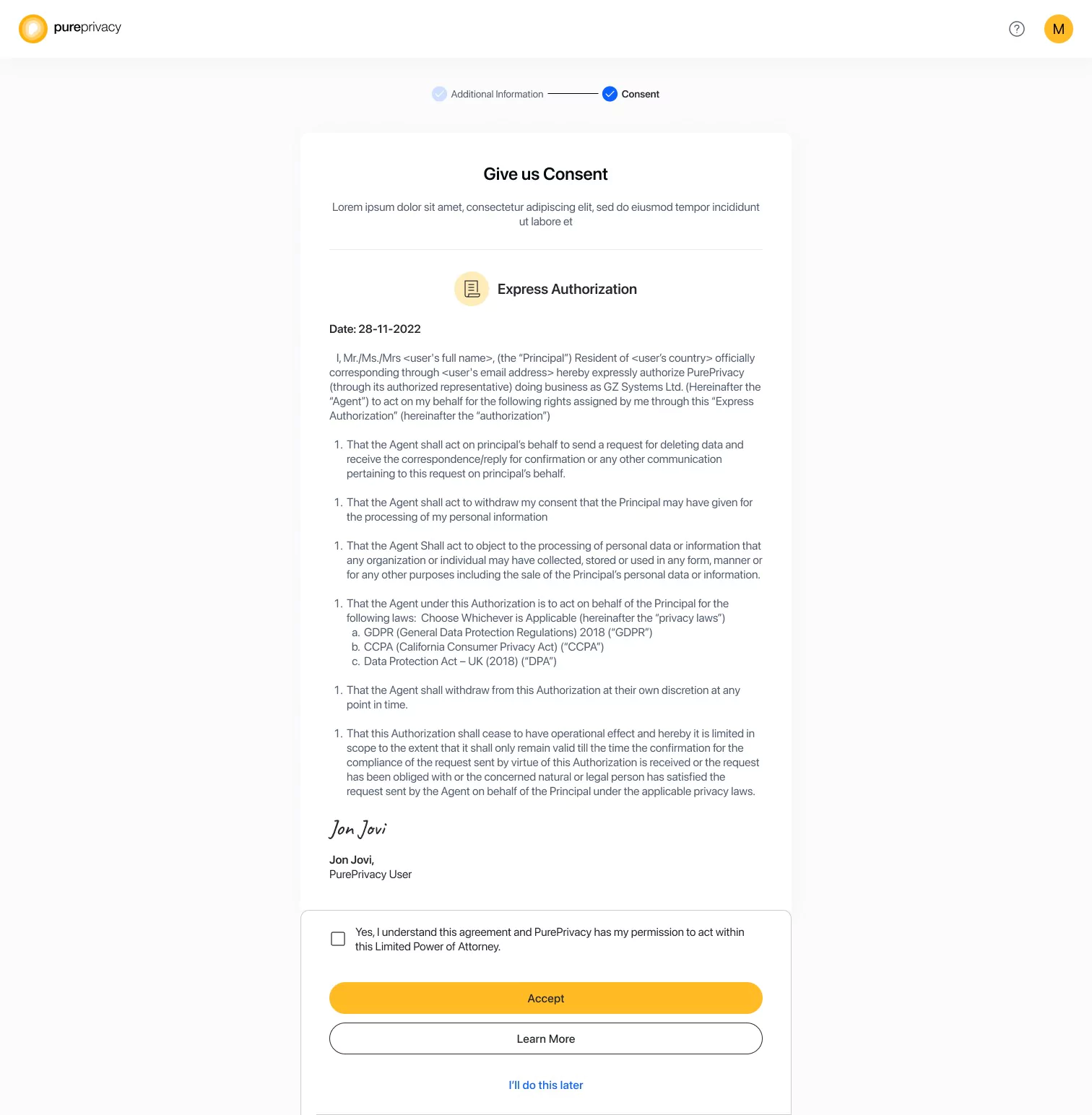

PurePrivacy is a social media privacy app that protects your online data and personal information. It gives you effective control over shared data. It gives you a guarantee that your data will not be shared unless you give permission.

A free version of the service is accessible without the need for a credit card, aimed at empowering users to manage their online privacy effectively and make informed decisions about their digital presence.

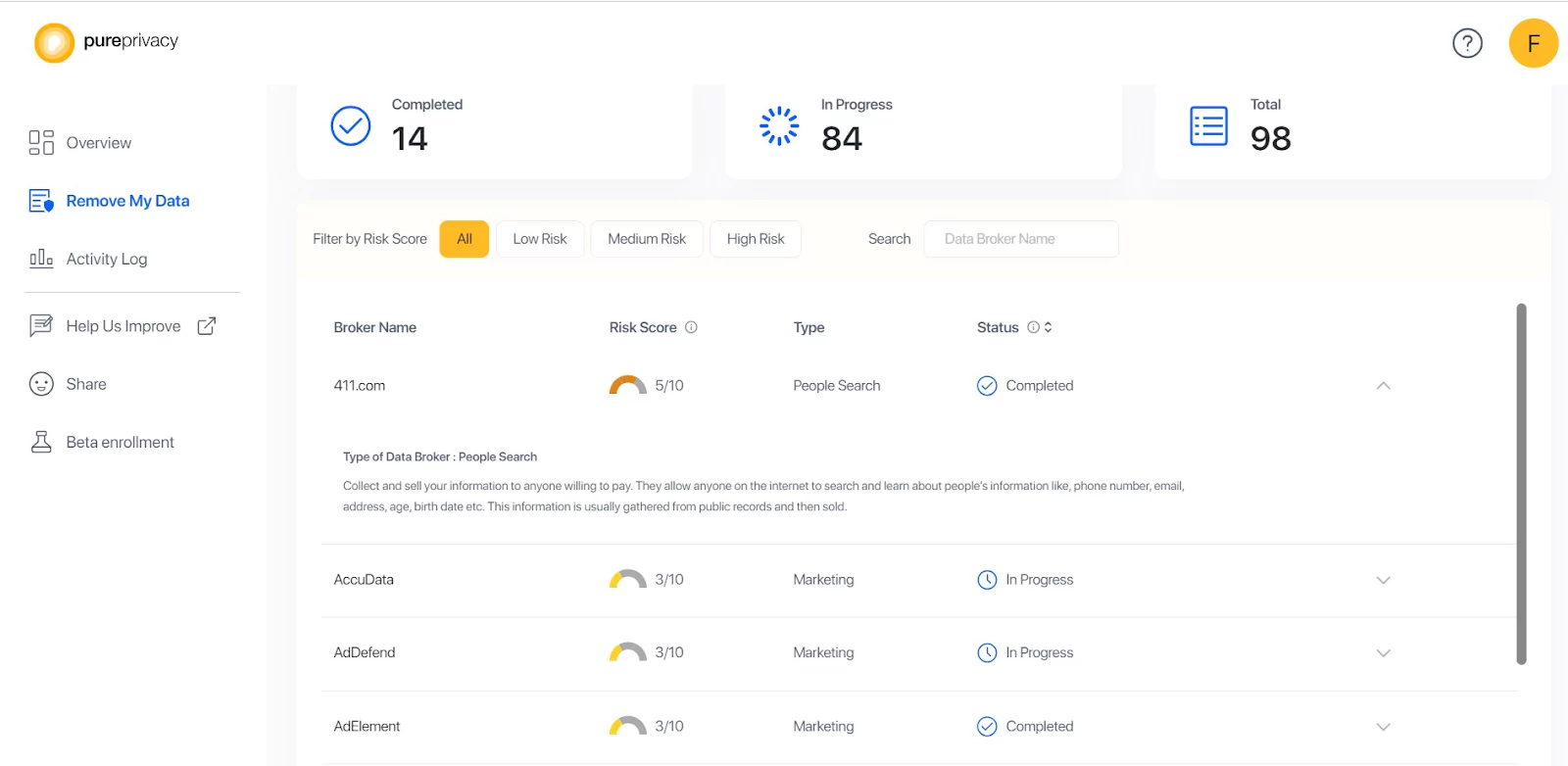

Instead of opting out of each data broker separately, using PurePrivacy allows for streamlined opt-out requests to multiple websites on a regular basis.

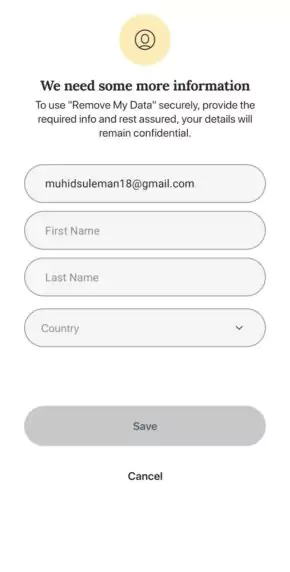

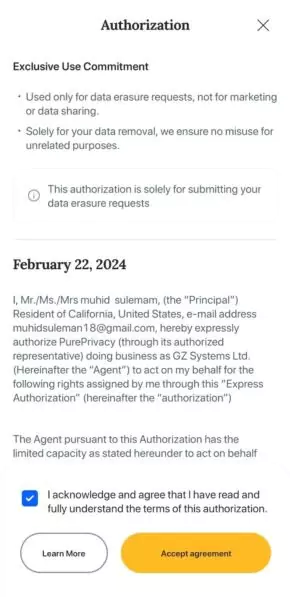

With PurePrivacy, not only can you efficiently monitor each opt-out request, but you can also save time by swiftly and easily removing personal data from more than 90 data broker websites.

Steps to Opt-Out Using PurePrivacy

Manual Opt-Out Vs. PurePrivacy

- Requires direct communication with TransUnion.

- Provides targeted control over specific data sharing or marketing practices.

- It may involve filling out forms or following specific procedures outlined by TransUnion.

- Offers a more focused approach to managing privacy concerns with TransUnion specifically.

- Involves adopting a broader mindset towards privacy.

- Focuses on minimizing personal information exposure across all platforms and services, not just TransUnion.

- This may include practices such as using privacy-focused tools and services.

- Offers a comprehensive strategy for protecting privacy beyond just one credit reporting agency.

Frequently Asked Questions (FAQs)

-

How does TransUnion get my information?

TransUnion gets your information from lenders, creditors, public records, and other data providers, as well as directly from consumers through their services.

-

How long does it take to opt- out from TransUnion?

Opting out from TransUnion's marketing lists usually takes a few weeks to process.

-

Can my data still be visible on TransUnion Opt-Out after successful data Opt-Out?

Opting out from TransUnion's marketing lists does not remove your data from their credit reporting database. Your credit information may still be visible to lenders and businesses for credit-related purposes even after successfully opting out of marketing offers.

-

Does TransUnion sell my data?

TransUnion, like other credit bureaus, provides credit information to lenders and businesses for various purposes, including assessing creditworthiness. While they don't "sell" individual data in the traditional sense, they do charge fees to access their database and services.

Stay Secured with PurePrivacy

TransUnion may share your data information with the highest bidders and data brokers. You may opt out of it whenever you want. You need to ensure that your data is kept and is not erased forever.

For this, there is a secure solution which is PurePrivacy, which protects your data and privacy. And, only share your information with those you chose with it. Plus, it will never share your personal information with anyone without your permission.